A Final Checklist for the CFPB’s Prepaid Account Rule

In less than one week, the Consumer Financial Protection Bureau’s (“CFPB”) prepaid account rule will take effect. The final, effective version of the rule comes after a lengthy rulemaking process spanning several years, numerous amendments, and delayed effective dates. The end result will be that, after the rule finally does take effect on April 1, 2019, the regulatory environment for prepaid and fintech companies will change, in some cases dramatically, so as such, companies will be subject to a host of new regulatory requirements and consumer protections.

Provided below is a brief checklist of some items to consider when your company reviews and modifies your processes and policies to comply with the prepaid rule:

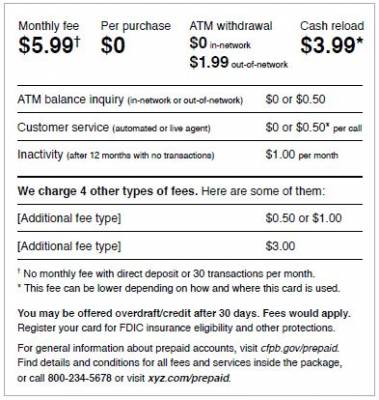

- Review your short form disclosure.

This may seem obvious, but given the prescriptive and highly detailed nature of the prepaid rule’s short form disclosure, it never hurts to review the form for a second (or tenth) time to make sure you have met all of the requirements. In conducting the review, it may be helpful to divide the disclosure up into its component parts, considering whether you have met the rule’s requirements with respect to (i) static fees, (ii) additional fee types, (iii) disclosure of fee variations, (iv) and other (e.g., overdraft protection, FDIC insurance, registration statement).

- If a service is not applicable, have you disclosed it as “N/A” instead of $0?

In reviewing your short form disclosure, note that if a service is not offered, you should list that service as “N/A” instead of disclosing it as having no fee (i.e., “$0”).

- Formatting requirements.

As noted above, the prepaid rule imposes a number of specific, detailed obligations with respect to the short form disclosure, including specific obligations with respect to font sizes and other formatting issues. A helpful resource in determining whether or not your form meets these requirements is the CFPB’s Guide for Preparing the Short Form Disclosure: the model form is included below and the guide is available here.

- Is terminology consistent across your account opening documents?

Make sure your terminology, especially with respect to fees you charge, is consistent across all of your disclosures including your long form, short form, and (if applicable) cardholder agreement. As an example, if you title a periodic fee as a “monthly fee” in your short form, don’t refer to it as a “periodic fee” in your other disclosures.

- Have you updated your cardholder agreements with the CFPB’s new model language?

Given the amount of attention paid to the prepaid rule’s pre-acquisition disclosures, it can be easy to miss the CFPB’s updates to the model language for error resolution and transaction histories under Regulation E. The new model language can be found in Appendix A-7 to Regulation E.

- Do your transaction histories include information required in periodic statements along with summary fee totals for the month and year to date?

As an alternative to providing a periodic statement under Regulation E, the prepaid rule allows providers to, assuming certain other conditions are met, make an electronic history of transactions covering the previous 12 months available to a customer. What is often missed in this obligation is that the electronic history of transactions provided to the customer still has to contain all of the information generally required to be provided as part of a Regulation E periodic statement.

In addition, your transactions histories under the new prepaid rule must include a summary of the fees charged to the accountholder for both the prior calendar month and the calendar year to date.

- Have you included required information on the access device itself?

The prepaid rule adds a requirement for an issuer to disclose on the card the issuer’s name as well as a website and phone number that a consumer can use to contact it about the prepaid account. If the issuer does not provide a physical access device, the issuer must include these disclosures on its website, mobile application, or other entry point that the consumer uses to electronically access the prepaid account.

If you have final questions or issues as you implement the prepaid rule, please don’t hesitate to let us know.