Renewable Energy Continues to Grow in Nebraska

Nebraska is among the top five states in the country for wind energy investment according to a 2020 report from the American Wind Energy Association (“AWEA”). Nebraska’s wind and solar resources continue to attract other new investment such as Facebook, Adobe, Hormel and Smuckers. Other economic giants are rumored to be looking at Nebraska due to its renewable resources and investment.

Nebraska’s renewable energy generation facilities are a considerable source of tax revenue to schools and other taxing entities. In 2019, renewable energy generated approximately $6,928,800 in nameplate capacity tax revenue. Nameplate capacity tax is a substitute for tax on personal property. Because wind turbines and solar panels are personal property that depreciates over their lifetime, the Nebraska Legislature created the nameplate capacity tax. The tax is a flat rate of $3,518 per megawatt of the project’s generating capacity for each year of the project’s lifetime. Even though the value of personal property, and thus the tax on personal property, typically depreciates, the nameplate capacity tax remains flat, thus providing additional financial benefits and stability to Nebraska’s taxing jurisdictions, including schools.

Renewable energy generation facilities also pay a similar amount in real property tax. Thus, the total new property tax from renewable energy generation facilities in Nebraska is approaching $12,000,000 per year. Especially for a small rural county, a share of this can be a significant benefit. For example, a 200 megawatt wind energy generation facility in Perkins County, Nebraska, would increase the county’s annual property tax revenue by approximately 40 percent.

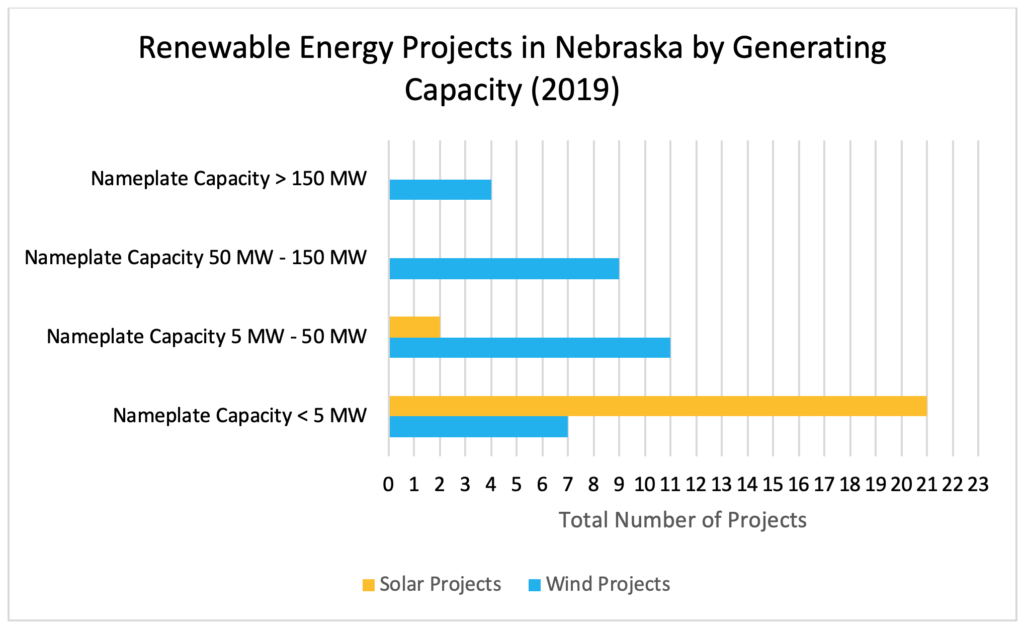

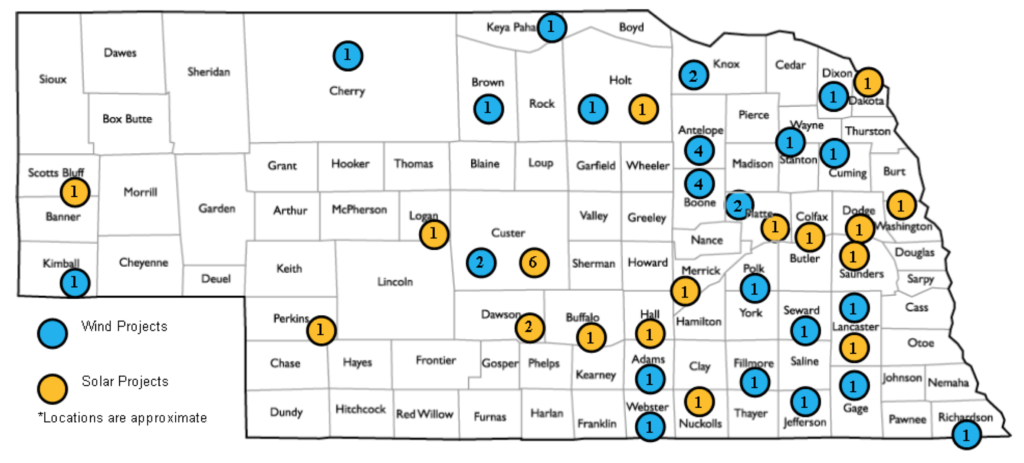

Renewable energy projects are increasing in Nebraska. According to the Nebraska Department of Revenue, at the end of 2019, there were 53 operating renewable energy projects in Nebraska, covering 35 of the state’s 93 counties. The projects generated approximately 2,040 megawatts of clean energy in 2019.

Of Nebraska’s renewable energy projects:

- 3 new projects went into commercial operation during 2019;

- 31 are wind energy generation facilities;

- 23 are solar energy generation facilities;

- 8 are exempt from the nameplate capacity tax because public power districts operate them; and

- 9 are community-based energy development projects.

Developers are in the process of constructing numerous renewable energy projects in 2020. We are aware of over 300 megawatts of wind energy generation capacity under construction and over 500 megawatts in late stage development. We are aware of over 1,500 megawatts of solar energy generation capacity under late stage development. We anticipate several developers will obtain permits to construct projects in 2020.

The Federal Government is incentivizing new renewable energy development in the remainder of 2020 and early 2021. Specifically, in May 2020, Congress extended the safe harbor for the renewable energy production tax credit (“PTC”) due to COVID-19. The safe harbor extension will provide renewable energy developers an additional year to begin project construction and maintain tax credit eligibility. Not only will developers benefit from the extension, but Nebraska ratepayers will benefit from cheaper electricity the PTC guarantees to public utilities. For a more detailed explanation of the PTC safe harbor extension and other changes, see this article.

Please do not hesitate to contact us if you have any questions about renewable energy development in Nebraska.