EEOC Issues Final Rules on Employer Sponsored Wellness Programs Under the ADA and GINA

On May 17, 2016, the Equal Employment Opportunity Commission (“EEOC”) issued final rules addressing the treatment of wellness programs under both Title I of the Americans with Disabilities Act (“ADA”) and Title II of the Genetic Information Nondiscrimination Act (“GINA”). The final guidance highlights certain changes from the EEOC’s earlier set of proposed rules and sets forth key differences in the treatment of wellness programs under the ADA and GINA and under HIPAA, adding an additional layer of complexity in crafting a comprehensive and compliant wellness program. The new notice requirements and the rules pertaining to financial rewards will apply prospectively to wellness plans beginning on the first day of the plan year beginning on or after January 1, 2017. The remainder of the provisions set forth in the final rules are meant to clarify already existing requirements for wellness programs.

ADA Final Rules

The ADA final rules govern “all wellness programs that include disability-related inquiries and/or medical examinations,” such as wellness programs requiring employees to complete health risk assessments (“HRAs”) or submit to biometric testing, and apply both to wellness programs that are connected to an employer-sponsored health plan and to stand-alone wellness programs. Under the final rule, employee wellness programs may include disability-related inquiries or medical examinations so long as:

- employee participation in the program is voluntary,

- the wellness program is “reasonably designed to promote health or prevent disease,”

- employer participation incentives do not exceed 30% of the total cost of self-only coverage, and

- written notice and authorization forms contain additional confidentiality requirements.

In order for a wellness program that is governed by the ADA to be considered voluntary, and in addition to the voluntariness requirements similar to those established under HIPAA, employers must now provide employees with a notice that is reasonably likely to be understood by the employee and explains the type of medical information collected and its use, to whom the medical information is being disclosed, restrictions on disclosure, and methods used to safeguard the employee’s medical information. The EEOC has published a sample notice for employer-sponsored wellness programs that can be found at https://www.eeoc.gov/laws/regulations/ada-wellness-notice.cfm.

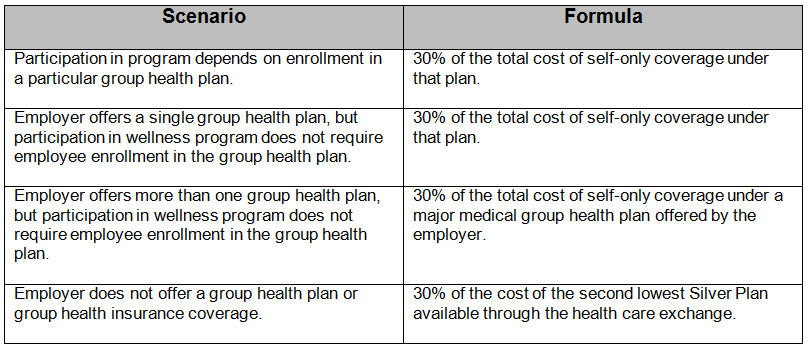

The EEOC has further provided that employers may offer limited incentives (either financial or in-kind) to encourage employee participation in wellness programs. The final rules reaffirm that incentives must not exceed 30% of the total cost of self-coverage, regardless of the level coverage in which the employee enrolled. The total cost includes both the employer’s and employee’s contribution. The table illustrates how to calculate the incentive maximums.

Finally, the final rules add two requirements to the confidentiality provisions set forth in the proposed rules. First, if an employer receives aggregate employee medical information as a result of the wellness program, the form of the aggregate medical information must not disclose or be reasonably likely to disclose the identity of specific individuals. Second, an employer may not require an employee to waive confidentiality protection or agree to the sale, exchange, or other disclosure of medical information as a condition of participation in a wellness program. The EEOC also reaffirmed its position that the ADA safe harbor provision regarding insurance does not apply to an employer’s decision to offer incentives in connection with wellness programs that include disability-related inquiries or medical examinations, despite at least one federal court ruling to the contrary.

GINA Final Rules

Title II of GINA restricts employers from requesting, requiring, or purchasing genetic information unless one of the six narrow exceptions applies. One of the exceptions allows employers offering health or genetic services in conjunction with a voluntary wellness program to request genetic information so long as certain requirements are met. The final rule clarifies that, under certain circumstances, an employer may “offer an employee limited inducements for the employee’s spouse to provide information about the spouse’s manifestation of disease or disorder as part of a HRA administered in connection with an employee-sponsored wellness program, provided that GINA’s confidentiality requirements are observed an any information obtained is not used to discriminate against an employee.” It is important to note that this narrow exception does not allow an employer to offer inducements for an employee’s genetic information or the manifestation of disease or disorder and genetic information of an employee’s children (children are, however, still allowed to participate in a wellness program).

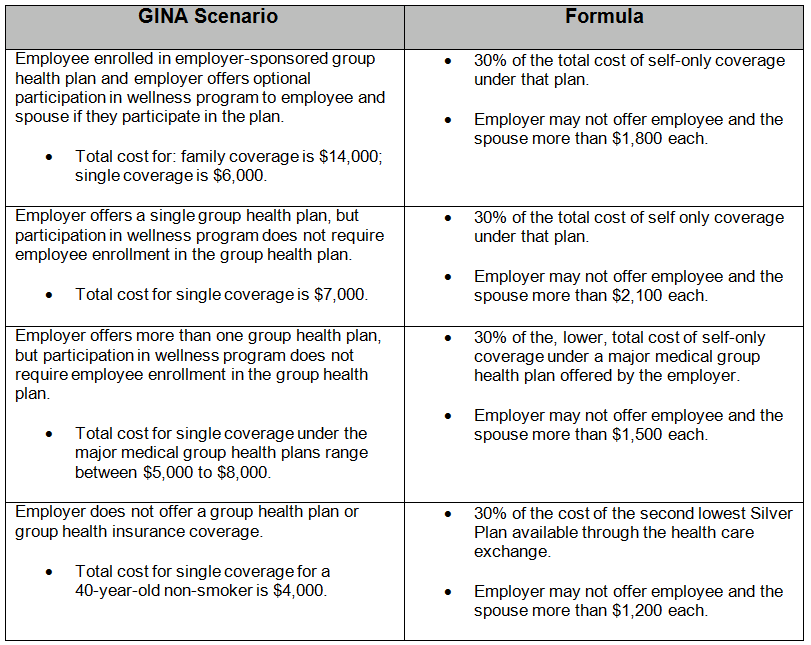

For consistency purposes, the employer incentive cap for providing a spouse’s genetic information is identical to the standard discussed in the ADA final rule. The table illustrates how the incentive cap is calculated under GINA.

As a reminder, GINA requires employers possessing employee genetic information to: (1) maintain the genetic information in a medical file; (2) keep medical files separate from personnel files; (3) treat genetic information as confidential medical records; and (4) obtain an authorization form signed by employees that explains that the employee’s genetic information is being provided to licensed health care professionals for health or genetic services and that the employee’s genetic information is not provided to employer except in aggregate form. While the final rule does not add additional confidentiality protection provisions, the rule does require that an employer must obtain written authorization from an employee’s spouse when the spouse is providing his or her own genetic information in connection with a wellness program.

Differences between HIPAA/ACA and ADA/GINA

The 2013 tri-Department final regulations that implemented HIPAA’s nondiscrimination provisions only apply to certain wellness programs. For example, if an employer provides an activity-based or outcome-based incentive in conjunction with a health-plan connected wellness program, then the tri-Department rules apply. Unlike the tri-Department rule, the ADA and GINA final rules apply to all wellness plans that make disability-related inquiries or require medical examinations. Because the ADA and GINA rules offer more protection for employees, the EEOC states in both rules that compliance with the HIPAA nondiscrimination regulations is not determinative of compliance with the ADA and GINA rules.

The applicability and interpretation of the reasonable design standard for wellness programs under each set of rules is different. The HIPAA reasonable design standard only applies to health-contingent wellness programs (incentive contingent on achieving a specific health goal); whereas, the ADA and GINA standard applies to participatory (incentive received by enrolling) and health-contingent programs. The HIPAA regulations state that health-contingent, outcome-based wellness plans must include a reasonable alternative standard (or waiver of the standard) for employees who are unable to meet the initial standard for the incentive. For example, if the results of an employee’s health-related testing do not qualify for a reward under an outcome-based standard, allowing that employee to obtain the same reward by completing an educational program is a reasonable alternative.

Under the ADA, however, an employer is required to provide a reasonable accommodation (a modification or adjustment) for a participatory wellness program. Reasonable accommodations should allow employees with disabilities to earn whatever financial incentive an employer offers, unless doing so imposes an undue hardship on the employer. For example, an employer offering a reward for completing a biometric screening involving a blood draw would need to provide an alternative test or certification method for an employee with a disability that makes blood draws dangerous in order for that employee to participate in the wellness program and earn the reward.

The ADA and GINA final rules impose employer incentive limits that do not completely align with the tri-Department final regulations. While HIPAA’s employer incentive limitation for individual (employee) participation in wellness programs is consistent with the limits under the ADA and GINA final rules, if a wellness program allows dependents to participate, then the employer incentive limit is 30% of the total cost of coverage (i.e., employee-plus-one or family coverage). In contrast, the ADA and GINA final rules implement a fixed employer incentive limit: 30% of the cost for self-only coverage. The ADA final rule does not adjust for plus-one or family coverage costs because the ADA’s prohibitions on discrimination apply only to applicants and employees, not their spouses and other dependents. Additionally, the GINA final rule is consistent with the ADA because the EEOC believes that increasing the employer incentive limit for spouses to disclose genetic information conflicts with the purpose of GINA and may be coercive.

Regarding tobacco-related cessation programs, the HIPAA regulations allow an employer to provide incentives that do not exceed 50% of the cost of self-only coverage or 50% of the cost of self-only and dependent coverage if dependents can participate in the program. Under the ADA and GINA, if the tobacco-related cessation program requires biometric testing or other medical procedures that test for the presence of nicotine or tobacco, then the 30% incentive cap applies. For example, if an employee tobacco cessation program only involves asking questions related to the employee’s smoking habits (e.g., have you smoked today?), then the 50% cap applies because the program does not involve medical information.

Significant changes between the ADA and GINA proposed rules and final rules

Under the GINA proposed rule, the formula for calculating an employer’s incentive cap for spouses was the difference between 30% of the total cost for family coverage and the total cost for self-only coverage. For example, if an employee is enrolled in a health plan that costs $14,000 for family coverage and $6,000 for self-only coverage, the employer’s wellness program incentive cap would be $1,800 (30% of $6,000) for an employee and $2,400 ($4,200 minus $1,800) for the spouse. The final rule eliminates this formula by stating that the formula for both employee and spouse is 30% of the total cost of self-only coverage.

Going Forward

Employers offering health-related wellness programs should review their programs by focusing closely on program elements that may trigger the ADA and GINA rules. Any programs involving disability-related questions, required medical examinations, or questions related to manifestation of disease or disorder in an employee or spouse should be reviewed for compliance with the final regulations. Employers should also reference the sample notice prepared by the ADA in developing their own notice to ensure compliance with the final rules’ notice requirements applicable to ADA-governed wellness programs.

Sean Nakamoto