Legislative Update Through the Halfway Point of the 2024 Nebraska Legislative Session

The Second Regular Session of the 108th Nebraska Legislature convened on January 3, 2024. This article marks the halfway point of the Session. Thirty legislative days remain in the session.

Through the first ten days of this session, we identified and analyzed 193 legislative bills of interest, including 91 carryover bills from last session. Links to those articles are here (Days 1‑5) and here (Days 6-10).

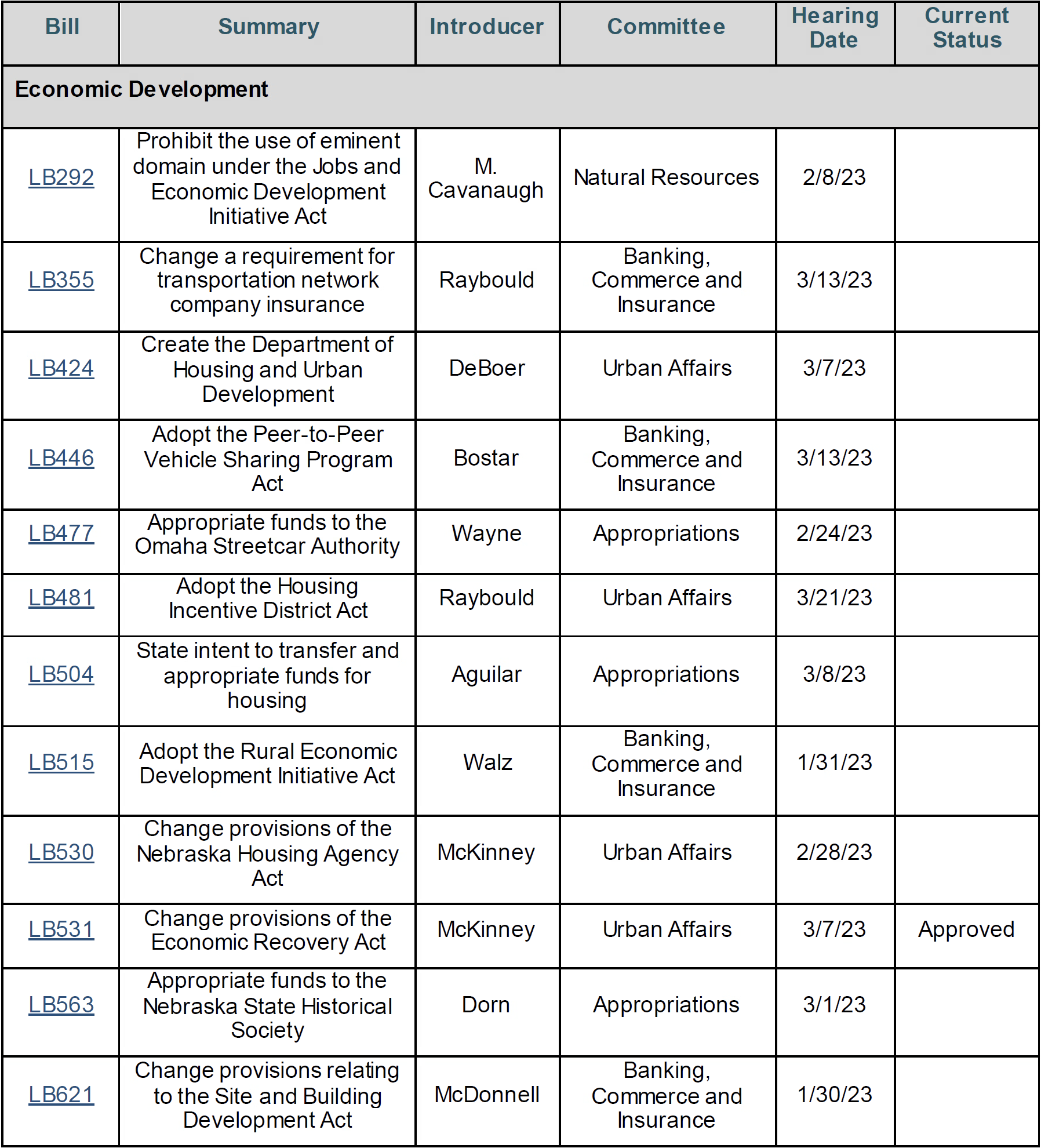

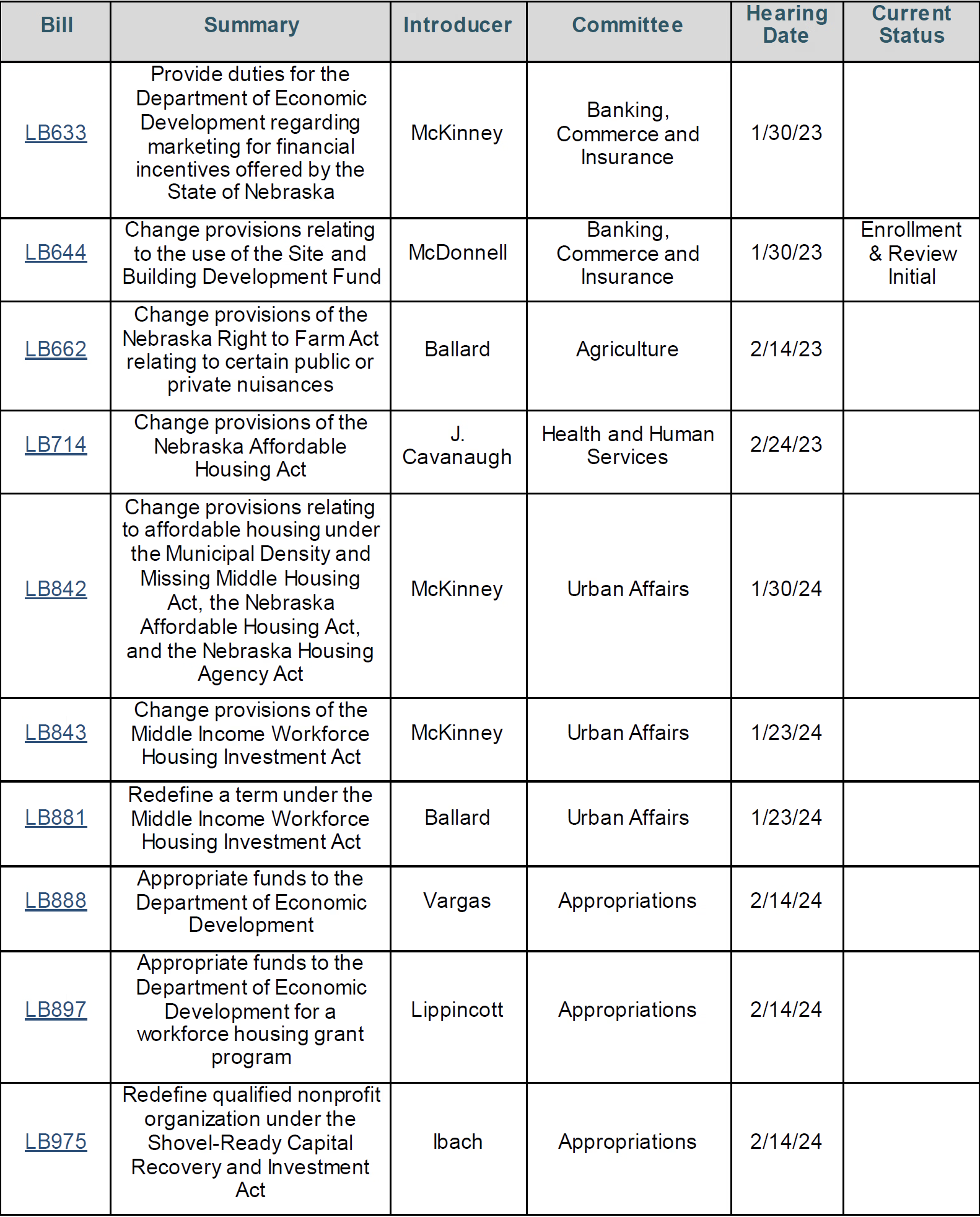

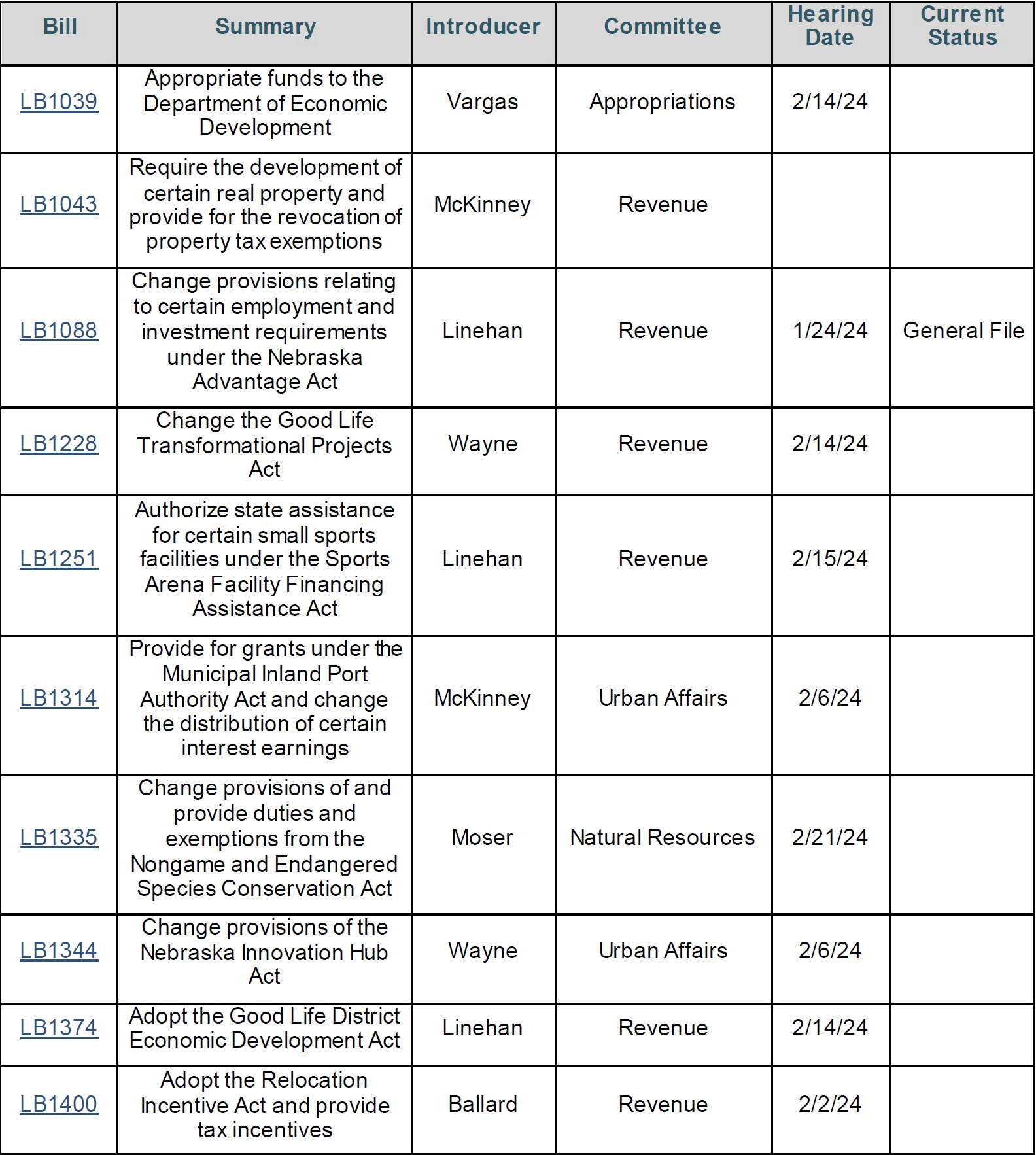

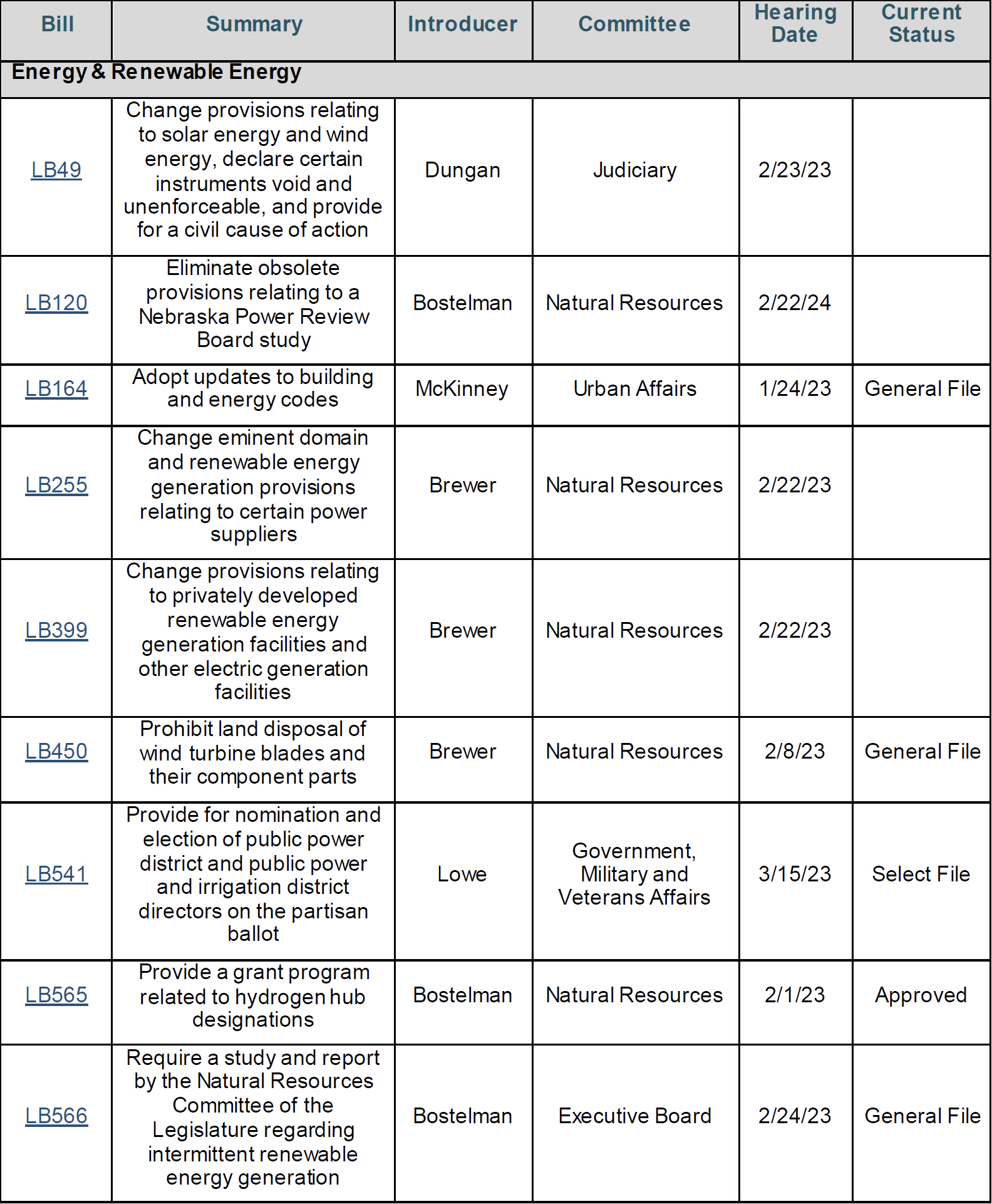

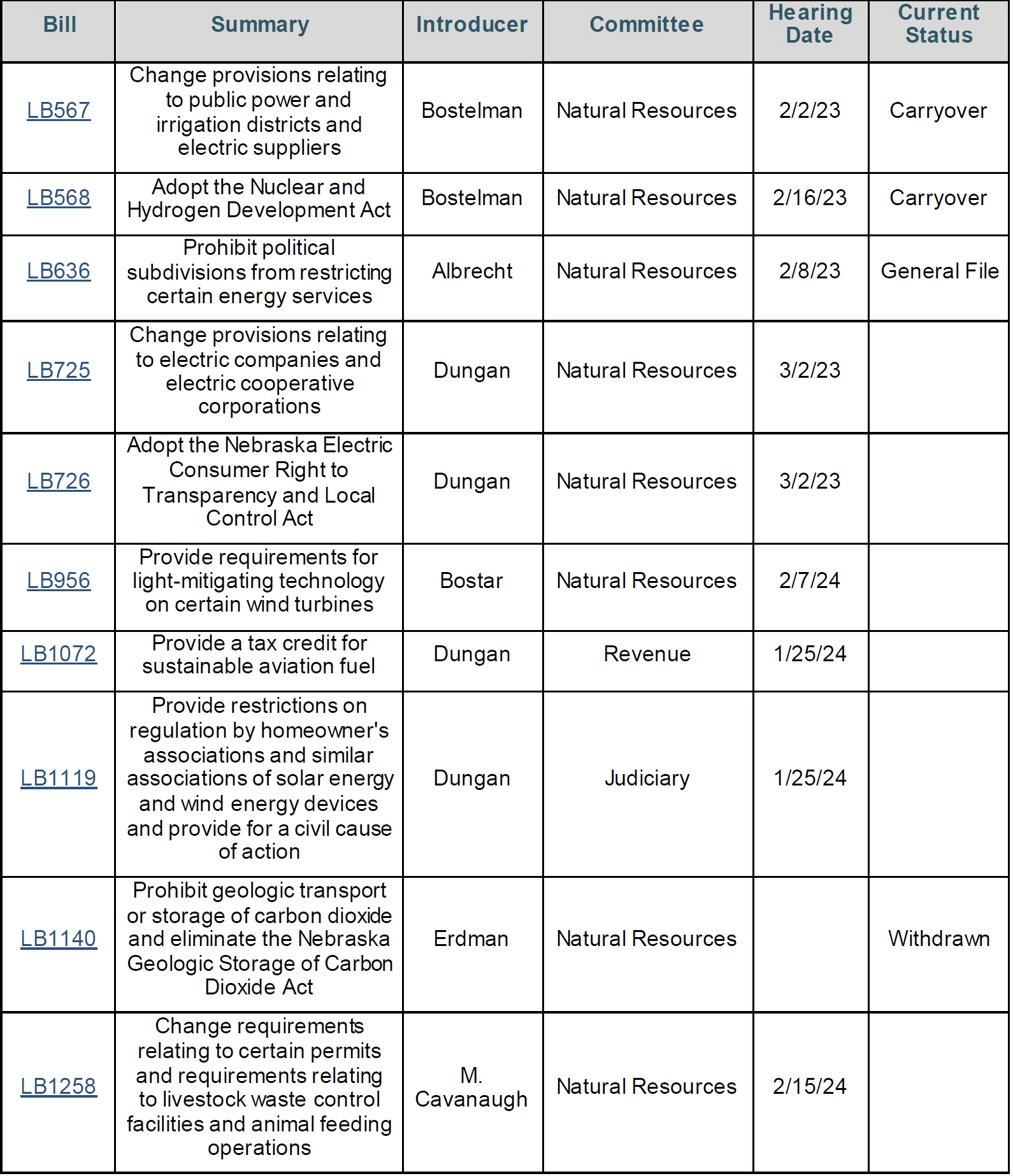

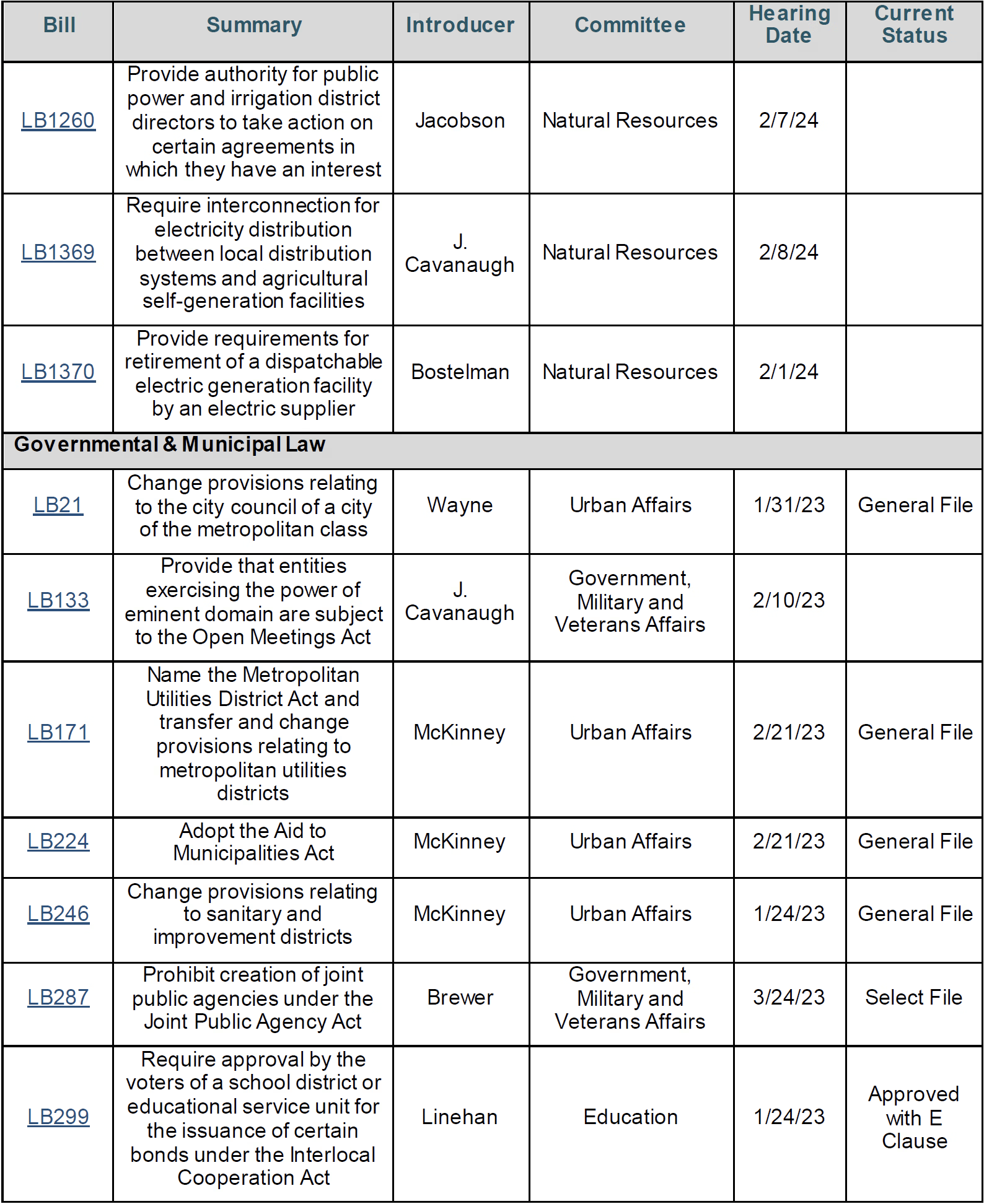

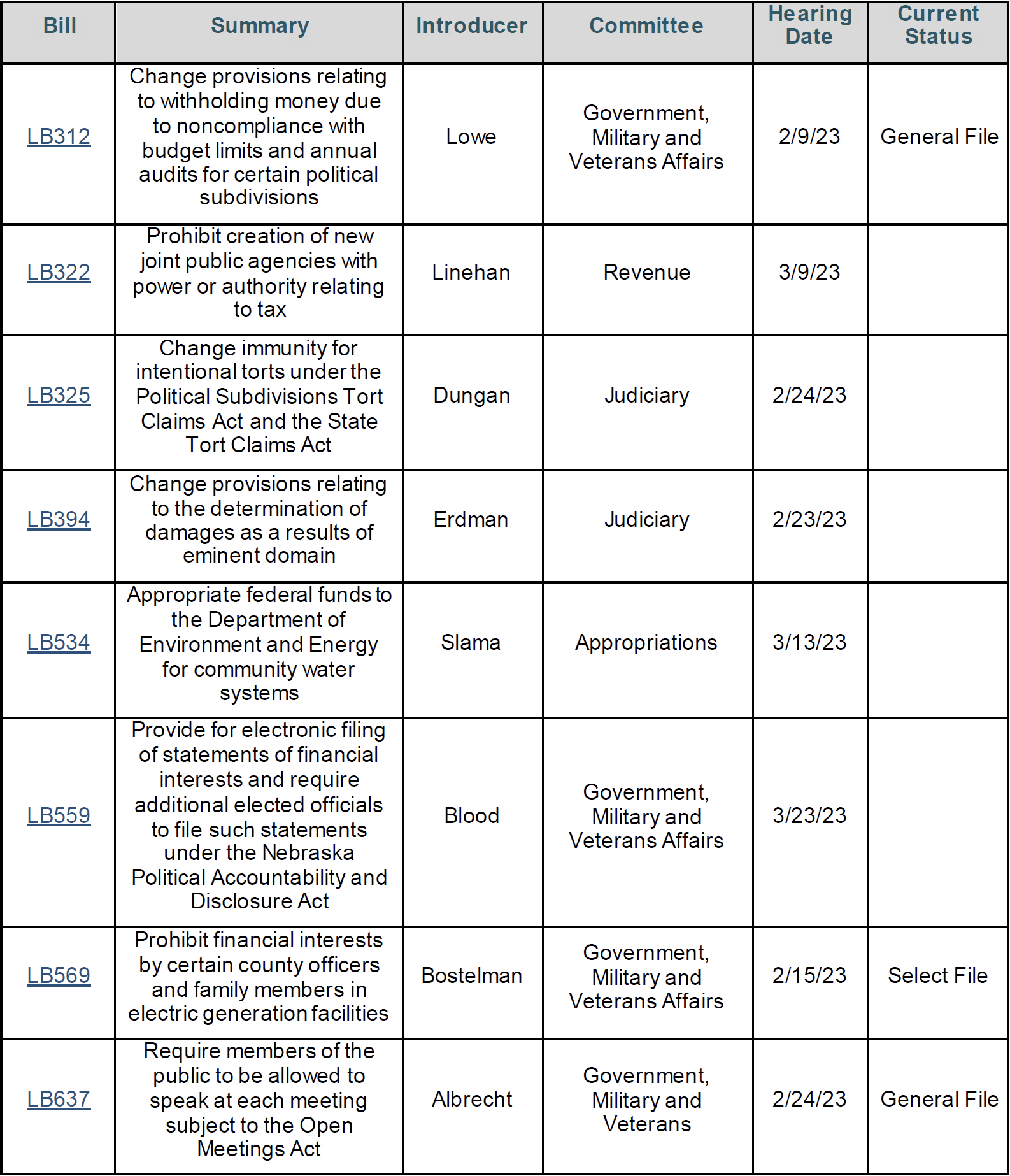

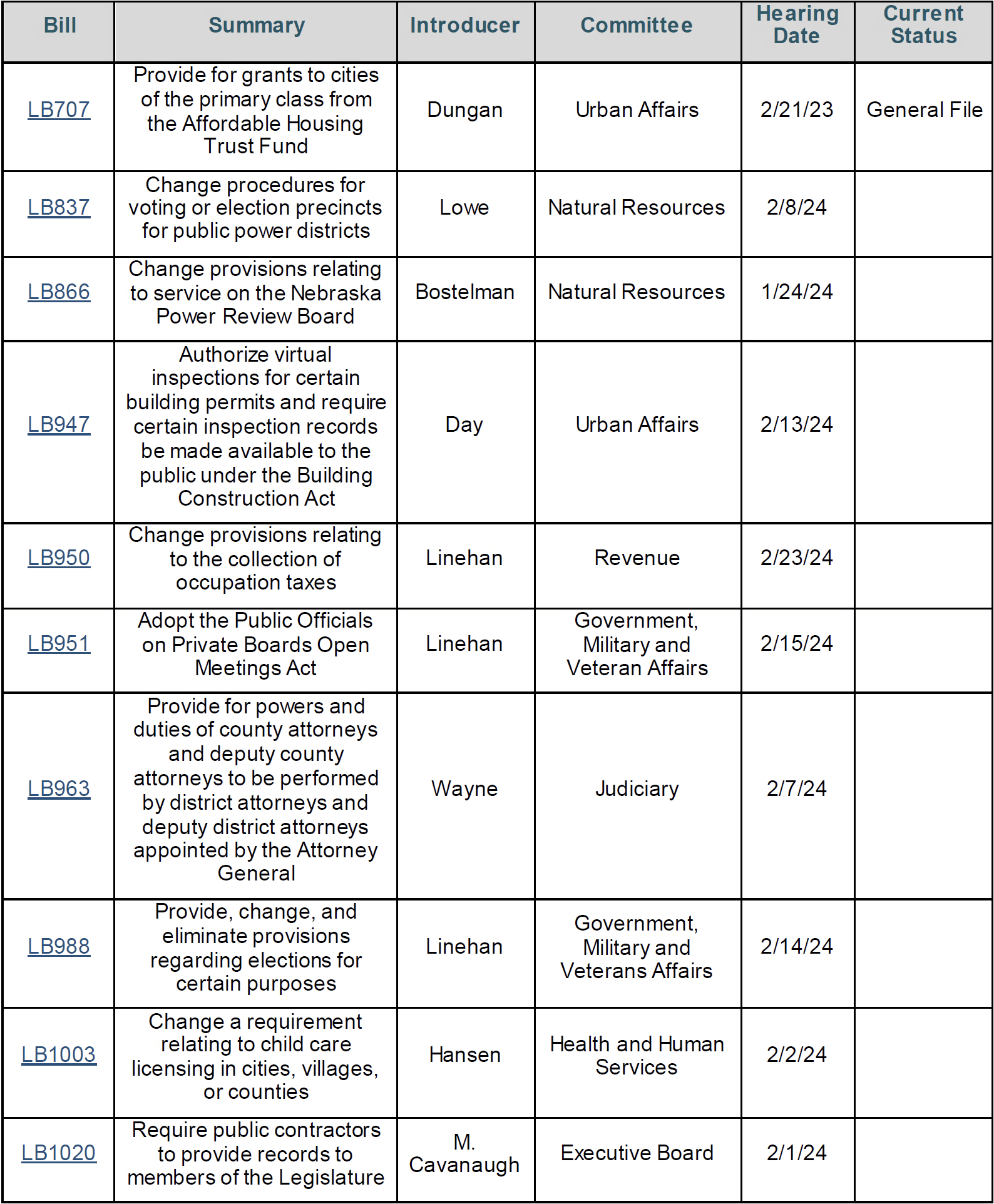

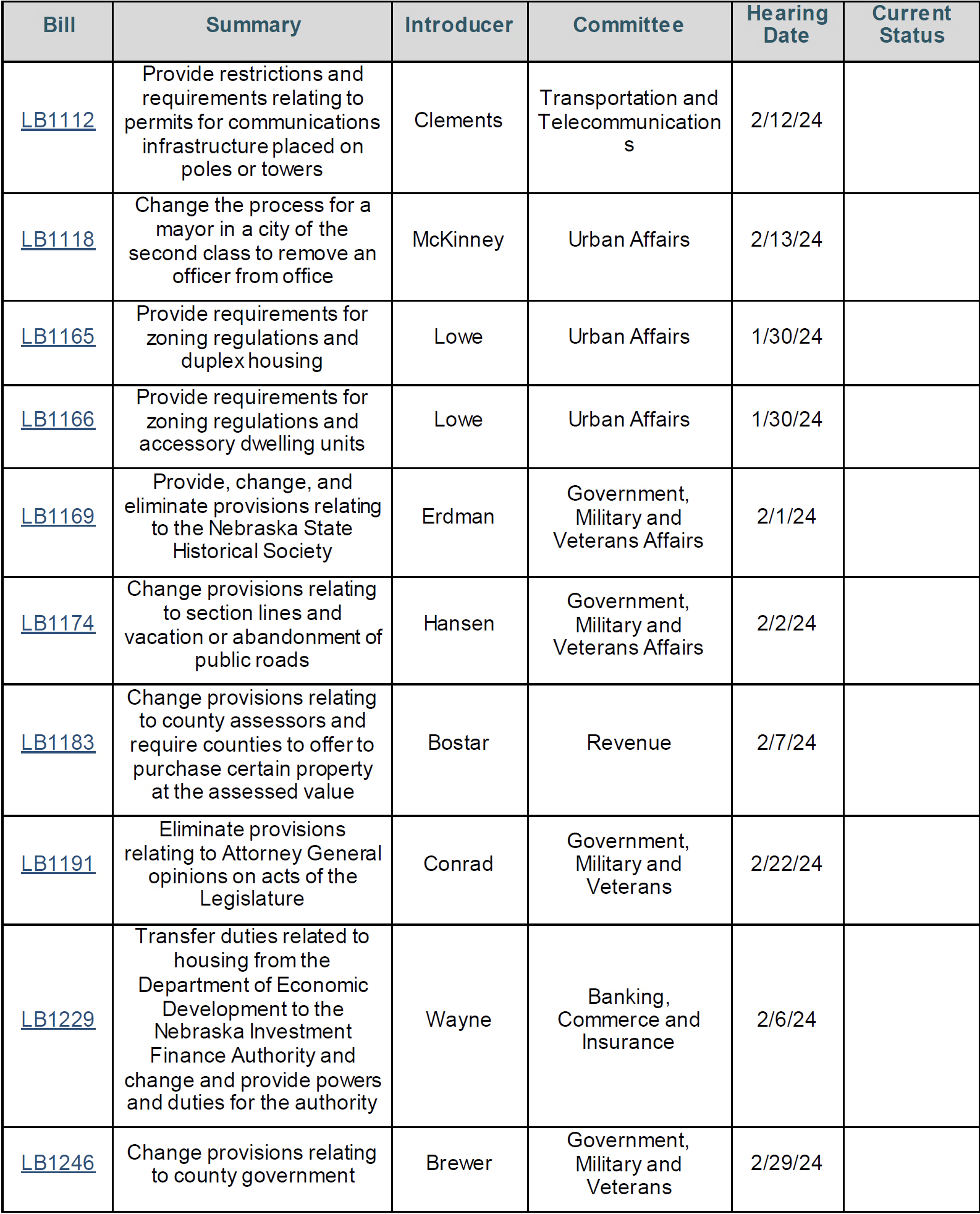

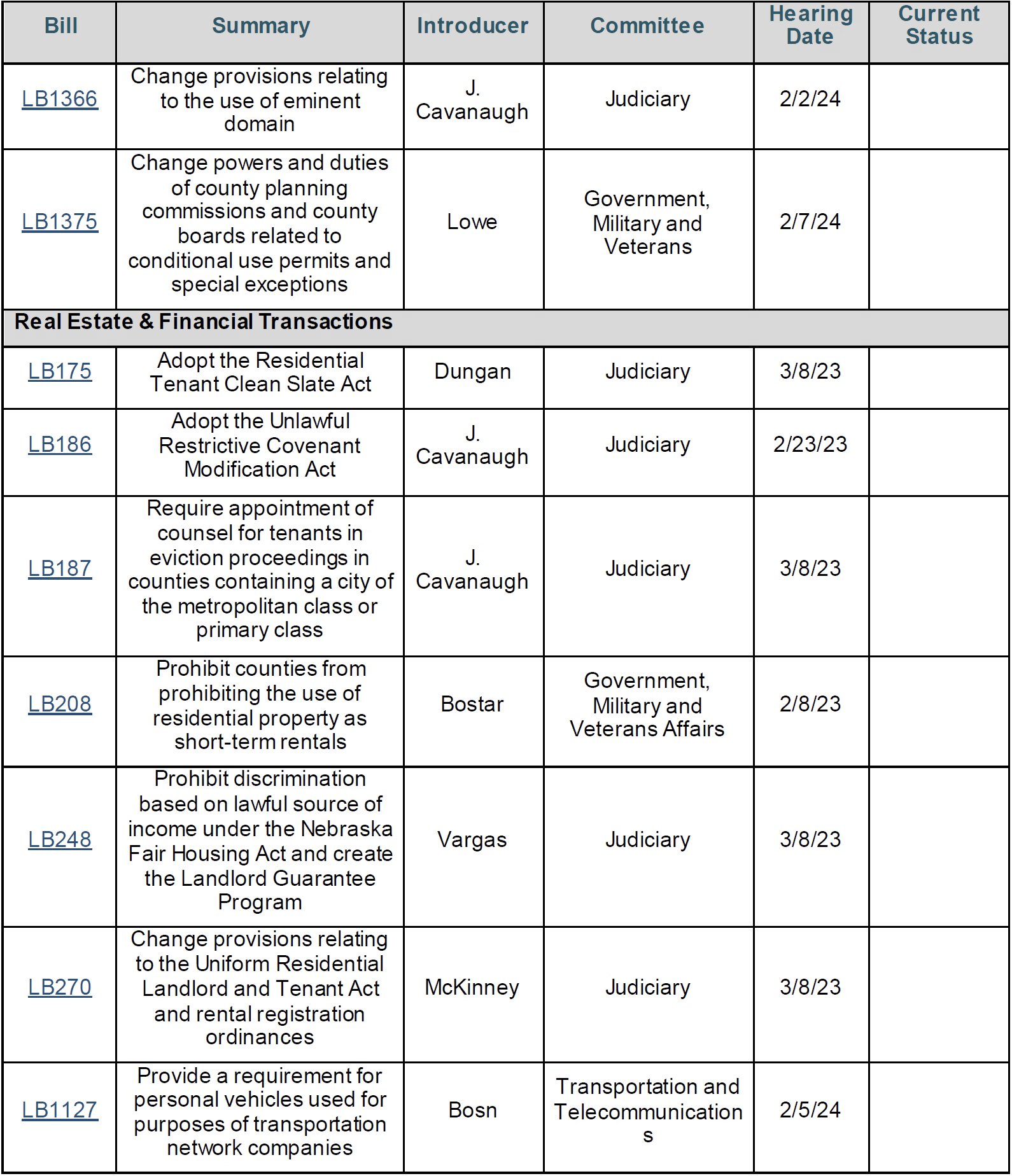

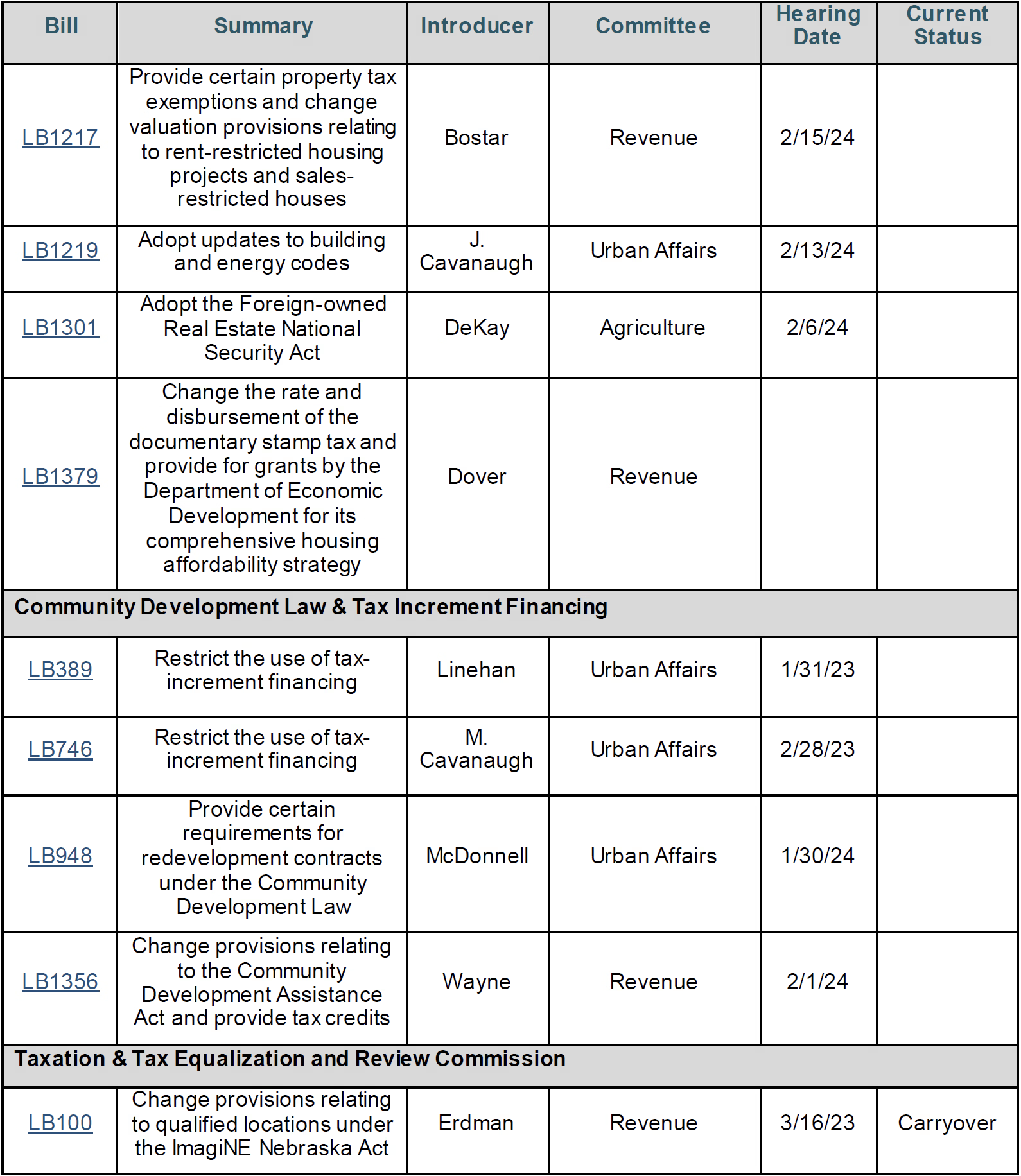

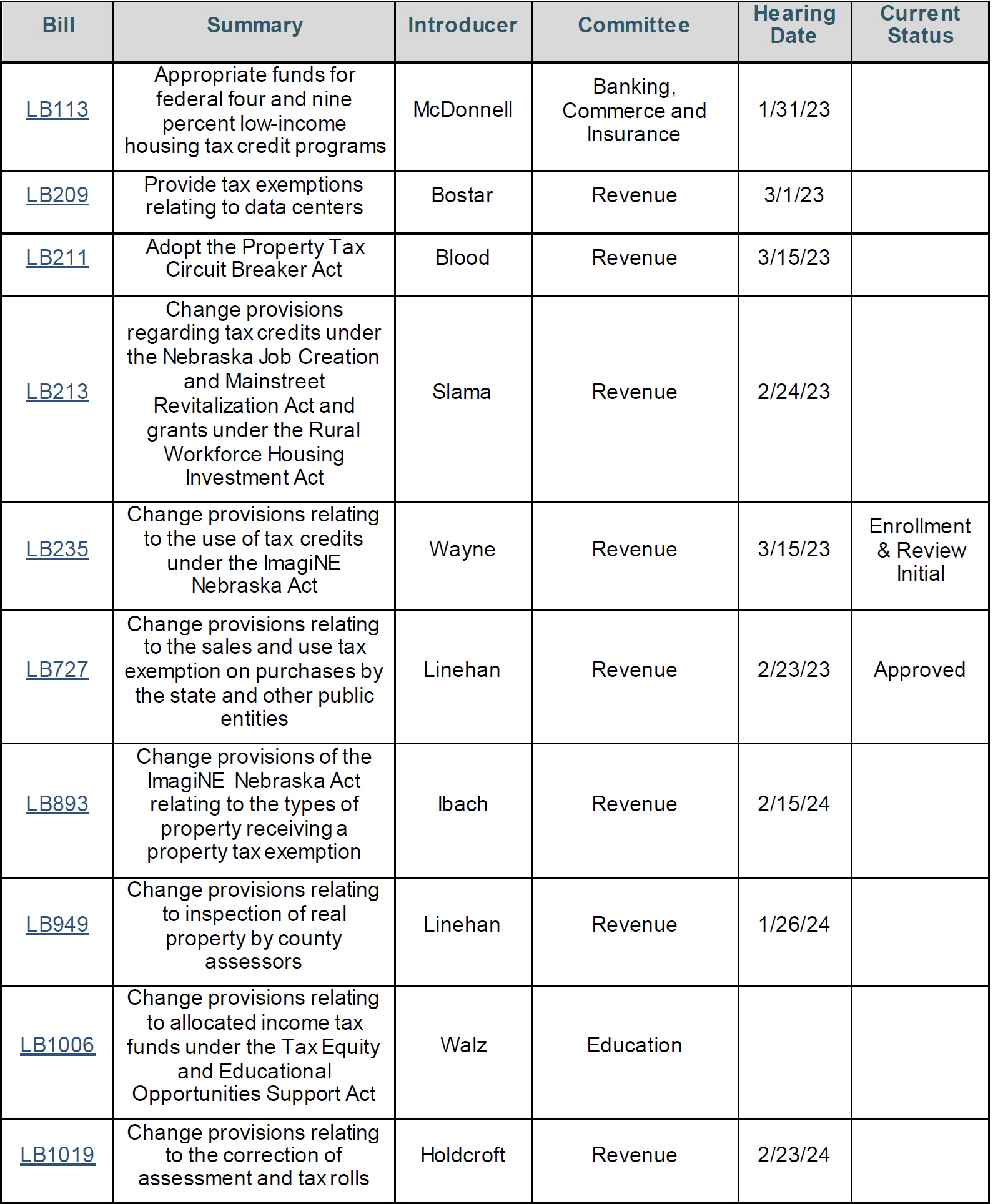

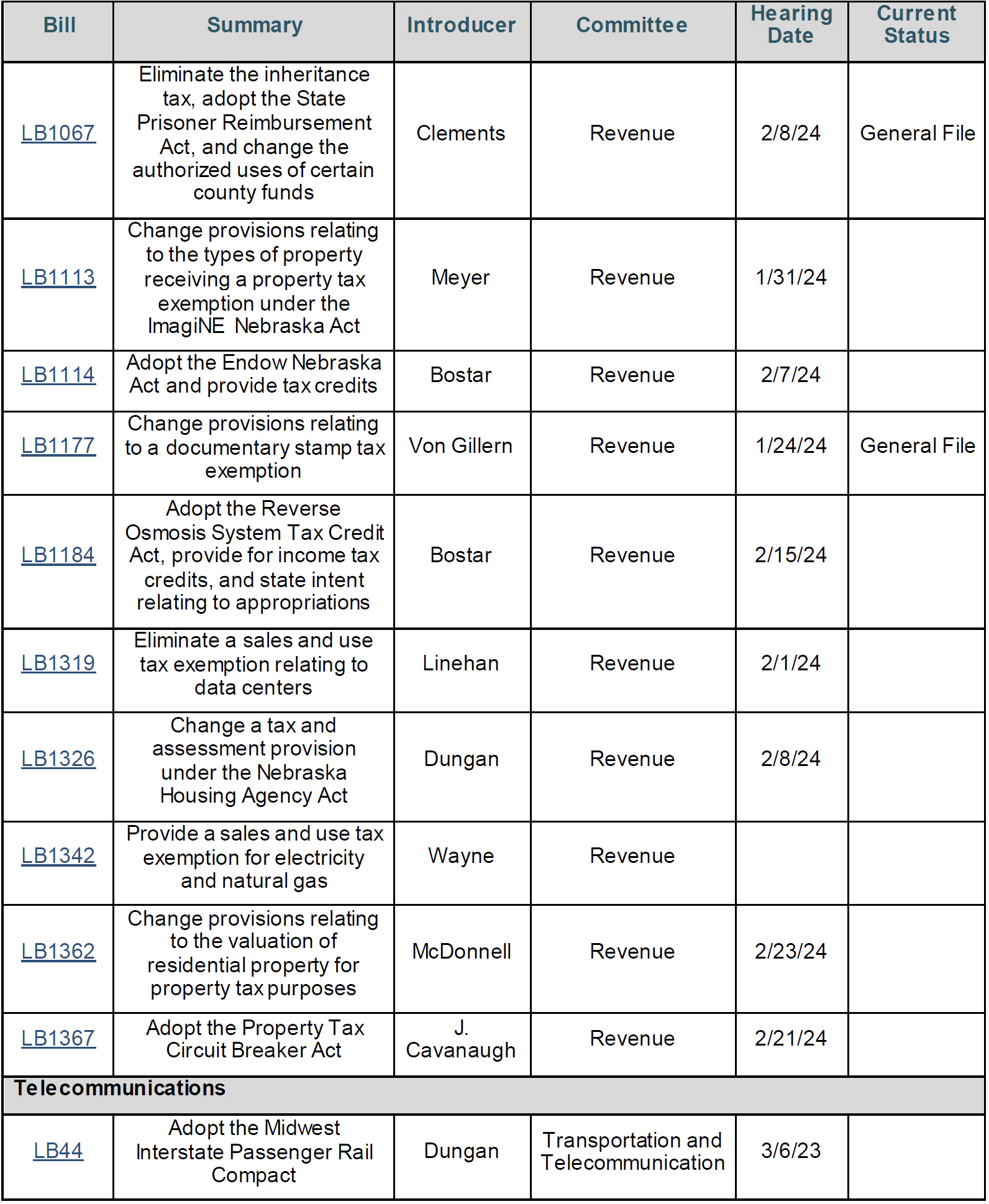

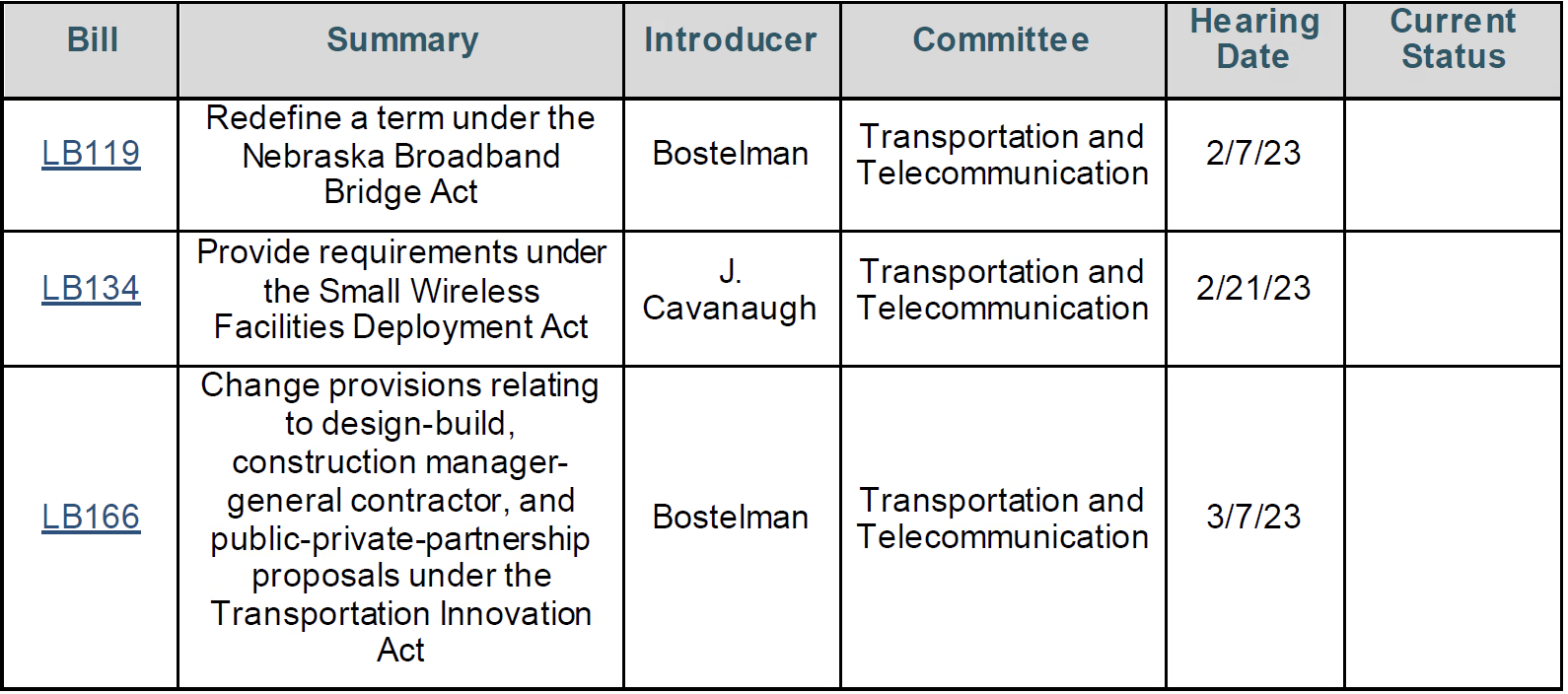

The Legislature has referred all of those bills to committees. We provide a chart at the end of this article giving the location of each bill in the legislative process. Immediately below, we analyze and summarize important updates for several legislative bills of interest.

Important Amendments to Legislative Bills of Interest

AM 2358 (McKinney) amends LB 1043 (McKinney) to exclude political subdivisions from the bill’s proposed deadlines and restrictions. The bill proposes to impose penalties on certain non‑profit development organizations that own “underutilized tax-exempt property” in “high-poverty area[s]”[1] for missing certain prescribed development deadlines. The bill would also prohibit any such non-profit development organization from selling such property in such an area for more than 50 percent above fair market value. Under AM 2358, these deadlines and restrictions would not apply to political subdivisions.

AM 2489 (Bostelman) amends LB 120 (Bostelman) to require certain electric suppliers and privately developed renewable energy generation facilities, before constructing a new facility within 10 miles of a military installation, to certify to the Power Review Board (the “Board”) that no facility components come from a “foreign government or foreign nongovernment person determined to be a foreign adversary pursuant to 15 C.F.R. 7.4.” 15 C.F.R. section 7.4(a) designates China, Cuba, Iran, North Korea, Russia and the Maduro Regime of Venezuela as foreign adversaries.

Senator Bostelman proposed LB 120 last Session. The Natural Resources Committee held a hearing but took no further action. The Committee will hold a hearing for AM 2489 on February 22, 2024.

LB 399 (Brewer) proposes to repeal Nebraska’s ministerial certification process for privately developed renewable energy generation facilities. Currently, such facilities need only receive Board acknowledgement of its receipt of notice of the developer’s intent to build.

LB 399, and a proposed amendment, would instead require the developer obtain approval from the Board prior to commencing construction. A prospective developer would need to submit an application to the Board and hold a public hearing. The developer must receive comments and substantiate the “need” for the facilities. After the hearing, the Board would elect whether to approve the application.

The Natural Resources Committee held a hearing on LB 399 on February 10, 2023. On February 15, 2024, Senator Bostelman designated it his priority bill. If this bill advances out of Committee, it will likely progress to the Legislative floor this session.

AM 1062 (Government, Military and Veterans Affairs Committee) amends LB 541 (Lowe) to require that board of director candidates for any public power district with more than $500 million dollars in gross annual revenue be on the partisan ballot at the Primary Election. All other public power districts would hold their elections at the General Election. Under existing law, the threshold gross annual revenue amount is $40 million dollars. See Nebraska Revised Statutes section 32-606(2). LB 541 initially proposed to require primary elections for all public power district’s board of director candidates.

Senator Lowe then designated LB 541, as amended, his priority bill on January 24, 2024. The Legislature placed the bill on Select File on January 31, 2024.

Legislative Bills of Interest on General File

LB 1067 (Clements) (E), with AM 2492 (Revenue Committee), proposes to (1) eliminate the Nebraska inheritance tax, (2) enact the State Prisoner Reimbursement Act and (3) permit counties to use up to 50 percent of proceeds in the County Visitors Promotion Fund or County Visitors Improvement Fund for other county purposes. The Nebraska inheritance tax would phase out between January 1, 2025, and January 1, 2028, by annually reducing the percentage of property subject to the tax. The bill would also reimburse counties quarterly that house inmates until the inmates either (a) transfer to a Department of Correctional Services facility, (b) commence probation or (c) return out of custody. The Legislature placed LB 1067, as amended, on General File on February 15, 2024. Senator Clements designed this bill as his priority bill on January 11, 2024.

LB 1177 (Von Gillern) would expand the documentary tax exemption for inter-family conveyances. It would specifically include step relationships and deeds transferring property to a corporation or limited liability company wholly owned by a single shareholder. On February 14, 2024, the Legislature placed LB 1177 on General File.

LB 1088 (Linehan) proposes to amend the Nebraska Advantage Act to change the time period in which a taxpayer must meet the requisite levels of employment and investment to earn tax incentives under the Act. Tier 1 and 3 projects (as well as Tier 6 projects approved prior to December 1, 2020) would need to meet the employment and investment thresholds by end of the fourth year. Tier 2 and 4 projects (as well as Tier 6 projects approved on or after December 1, 2020) would need to meet the employment and investment thresholds by end of sixth year. The Legislature placed LB 1088 on General File on February 14, 2024.

Legislative Bills of Interest on Select File

There are three legislative bills of interest on Select File. We discussed LB 541 above. The other two are LB 287 and 569.

LB 287 (Brewer) proposes to prohibit creating any joint public agencies on or after October 1, 2023, under the Joint Public Agency Act. See Nebraska Revised Statutes section 13-2501 et seq. The Legislature placed this bill on Select File on February 5, 2024. It is currently under Enrollment and Review.

LB 569 (Bostelman), as amended by AM 971 (Government, Military and Veterans Affairs Committee), proposes to require any county board or planning commission member, or his or her immediately family members, that has a direct or indirect financial interest in the development of an electric generation facility or the land used therefore, to hold a public hearing announcing said relationship. The bill would also require such county board of planning commission member to announce how he or she intends to vote on the matter. As originally introduced, a county board or planning commission member would be entirely prohibited from participating in the vote. The Legislature placed this bill on Select File on February 14, 2024. It is currently under Enrollment and Review.

Passed Legislative Bills of Interest

One legislative bill of interest passed this session. Governor Pillen approved LB 299 (Linehan) on February 13, 2024. This bill requires that any joint entity involving a school district or educational service unit must receive voter approval to issue bonds at either the Primary or General Election. If voters reject the bond issuance proposal, the joint entity must wait at least six months to resubmit the matter to the ballot.

Attorneys at Baird Holm LLP have experience in legislative, municipal and local governmental matters. Please do not hesitate to reach out if you have any questions. Please see below for a complete chart tracking the progress of all legislative bills of interest.

[1] LB 1043 defines “underutilized tax-exempt property” as tax-exempt property that is “completely undeveloped or contains deteriorating structures.” A “high-poverty area” is an area that consists of one or more continuous census tracts in which more than 30% of persons’ income is below the poverty line.

[1] LB 1043 defines “underutilized tax-exempt property” as tax-exempt property that is “completely undeveloped or contains deteriorating structures.” A “high-poverty area” is an area that consists of one or more continuous census tracts in which more than 30% of persons’ income is below the poverty line.