Nebraska Updates Job Creation and Mainstreet Revitalization Act Presenting Significant Opportunity for Developers in 2023

The Nebraska Legislature recently amended the Job Creation and Mainstreet Revitalization Act (the “Act”).[1] These amendments reinstated the program, which had sunset on December 31, 2022, allowing the Act to continue to incentivize the restoration of Nebraska’s historic properties. However, important changes in program caps will impact the program in future years.

The Act encourages rehabilitation of historic properties in Nebraska by offering a state tax credit for qualified expenditures. Limitations exclude some projects from receiving credits. For example, single family homes are ineligible for the tax credits, and projects must meet minimum cost requirements. A qualified property must be listed in the National Register of Historic Places, located in a historic district, or designated as historically significant by the State Historic Preservation Officer.

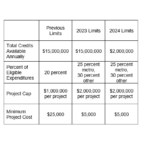

As amended, the program includes the following parameters:

Adjustments to the Act may impact the amount of tax credit your project can receive in 2023 and beyond. First, and most importantly, the amendments introduce new program caps. The program will offer up to $15,000,000 in total credits for the remainder of 2023. However, the amount of tax credits will decrease significantly in 2024 with a program cap of only $2,000,000.

Second, the Act previously allowed for a tax credit of 20 percent on eligible expenditures for all projects. The amendments now increase the tax credits to 25 percent for a project in a metropolitan or primary class city, and 30 percent for a project in any other county.

Third, the Legislature raised the project caps. Previously, a single project was eligible for a maximum $1,000,000 in tax credits. The amount now doubles to $2,000,000 in available tax credits for a single project.[2]

On the other hand, the minimum total cost for an eligible renovation has now decreased to $5,000. This allows for smaller projects than the program did previously.[3]

Applications for these historic property tax credits are set to open again in early September. Baird Holm attorneys have extensive experience in navigating this application process. Reach out to us for advice in getting maximum Nebraska tax credits for your historic property renovation.

[1] Neb. Rev. Stat. §§ 77-2901 to 77-2912.

[2] For example, under previous rates and project caps, an $8,000,000 metropolitan project was eligible for $1,600,000 in tax credits, but due to project caps, the amount of credit given decreased to $1,000,000. Now, the same $8,000,000 project can claim $2,000,000, the full 25 percent tax credit, it was expecting.

[3] The program previously reserved specific amounts of the total funds and established a priority window for small projects costing under $100,000. As amended, the reservation of funds for small projects no longer applies.