Summaries from Days 1-5 of Nebraska Bill Introduction

The First Regular Session of the 109th Nebraska Legislature convened on January 8, 2025. As of January 21, 81 legislative days remain in the session. The Legislature plans to adjourn sine die on June 9, 2025.

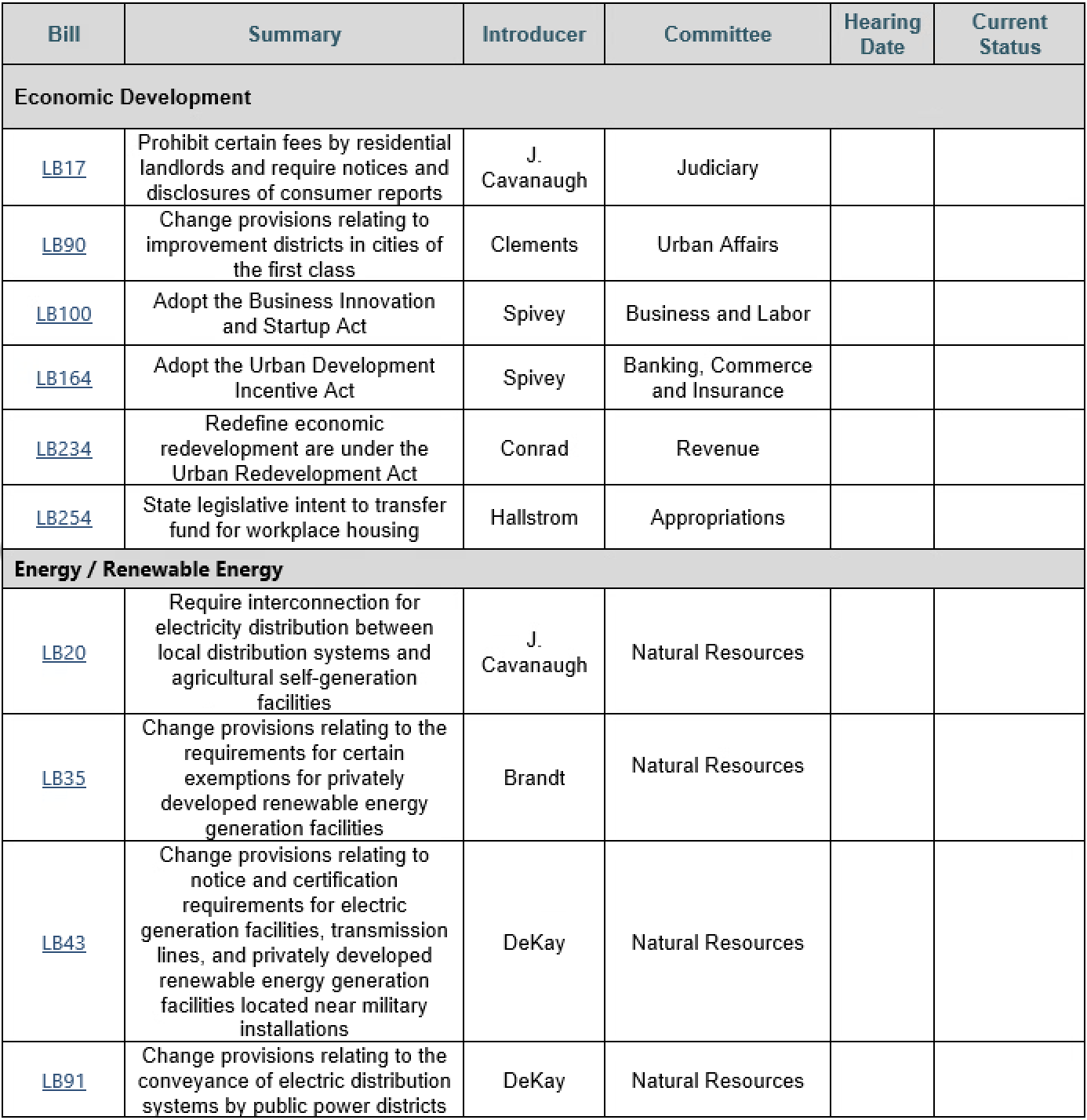

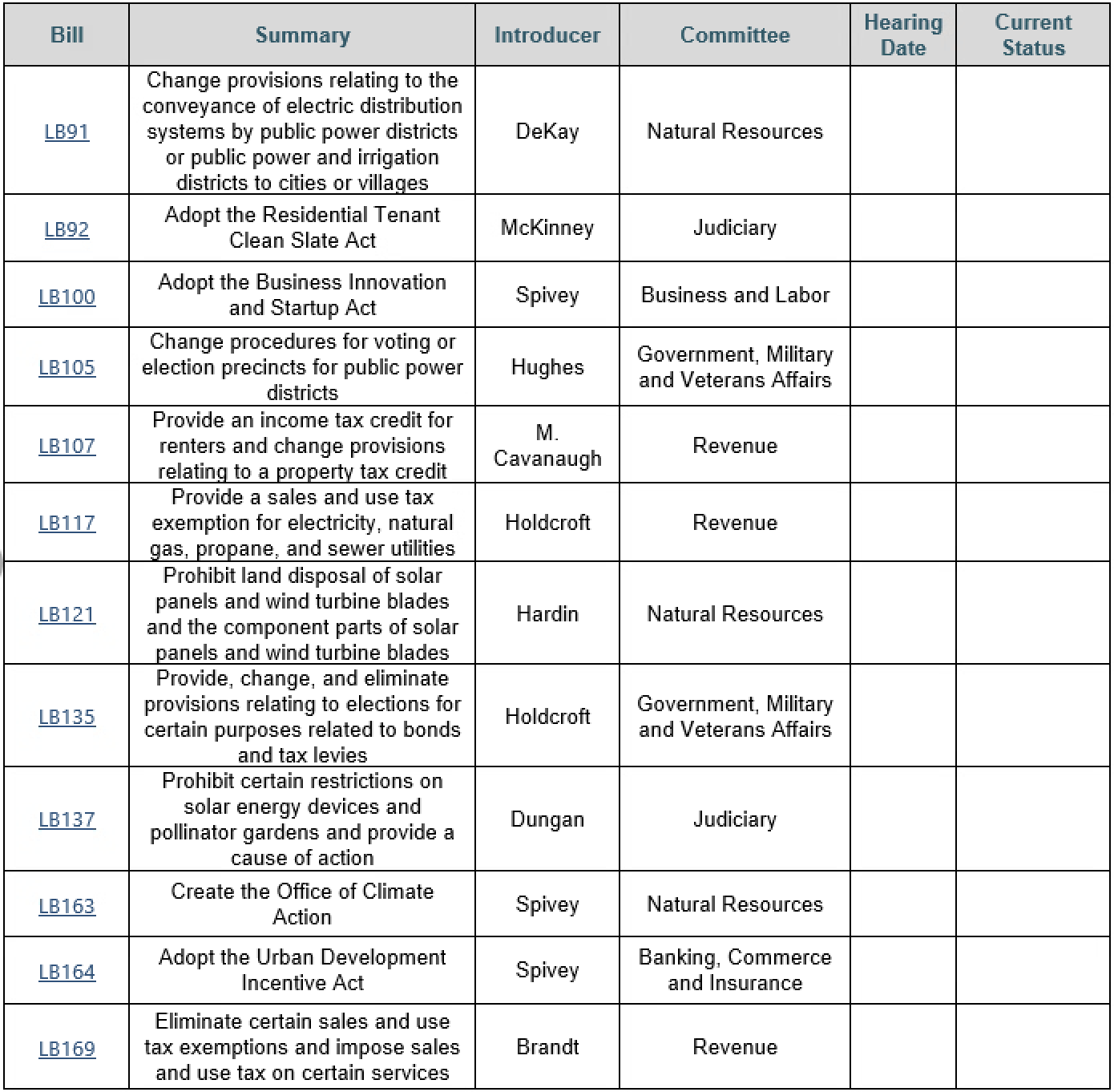

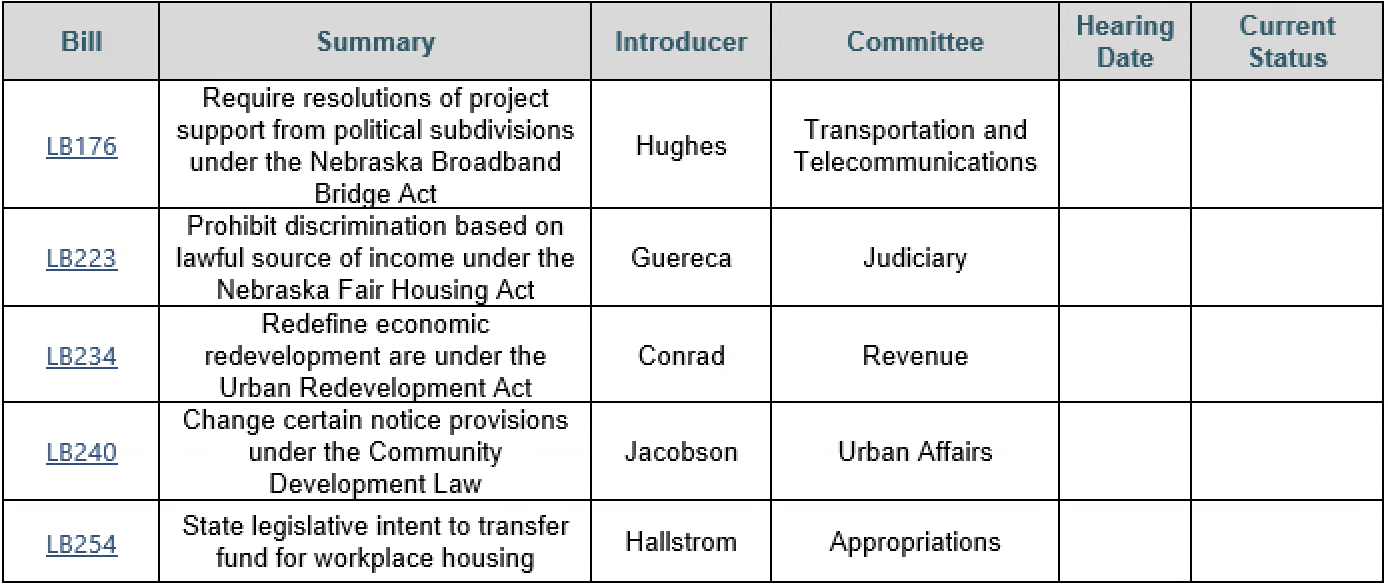

Bill introduction will conclude on January 22, 2025. Through the first five days of bill introduction, we identified twenty-eight (28) bills that could significantly impact land use, real estate and energy law in Nebraska. Below are summaries of those bills, separated by category. A chart is available at the end of this article.

The first four bills we outline in greater detail below, however, will be of particular interest to those working within the real estate and renewable energy industries:

LB7 (DeKay) proposes to revise the Foreign-owned Real Estate National Security Act. Currently, the act is ambiguous as to what the term “foreign entity” actually encompasses. This means an entity incorporated in any state other than Nebraska, is arguably a foreign entity under the act and unintentionally subject to higher levels of regulation.

To address this, the bill would define “foreign government” to include any government other than the United States government or the government of any state, political subdivision, tribe or territory of the United States. Further, foreign and restricted entities would need a determination from the Committee on Foreign Investment in the United States they pose no national security concerns in a land sale. Finally, the bill would compel a foreign and restricted entity to secure a national security agreement with the Committee on Foreign Investment in the United States when transacting a land sale. On January 13, 2025, the Legislature referred this bill to the Agriculture Committee.

LB20 (Cavanaugh, J.) would establish new requirements for the interconnection of electricity distribution between local distribution systems and agricultural self-generation facilities. The bill would define agricultural self-generation facilities, local distribution systems, and local distribution utilities to add clarity to this growing area of commerce. It would then prohibit local distribution utilities from denying service to a customer owning an agricultural self-generation electricity facility. Further, it would require the owner-generator to comply with interconnection requirements, safety standards, electric rates and charges, and service agreement requirements. On January 13, 2025, the Legislature referred this bill to the Natural Resources Committee.

LB50 (DeKay) proposes to alter the distribution of the Nameplate Capacity Tax for renewable energy generation facilities. Currently, the law directs county treasurers to distribute the revenue the Nameplate Capacity Tax generates to local taxing entities that do not receive tax revenue from renewable energy sources due to the personal property tax exception. The bill would explicitly compel these county treasurers to first distribute five percent (5%) of the generated Nameplate Capacity Tax revenue to the community college area in which the renewable energy generation facility is located. The bill would then direct the county treasurer to distribute the remainder to local taxing entities as previously indicated. On January 13, 2025, the Legislature referred this bill to the Revenue Committee.

LB121 (Hardin) would prohibit land disposal of solar panels and wind turbine blades under the Integrated Solid Waste Management Act. The bill would also prohibit landfills in the state of Nebraska from accepting the disposal of any component parts of solar panels or wind turbine blades. On January 14, 2025, the Legislature referred this bill to the Natural Resources Committee.

Attorneys at Baird Holm LLP have experience in many areas of the law including government and lobbying, legislation, and economic development. Please do not hesitate to contact the firm should you have any questions. The remaining bills below from days one through five of bill introduction each pose to impact the real estate and renewable energy sectors in various degrees.

ECONOMIC DEVELOPMENT

LB17 (Cavanaugh, J.) proposes to amend the Uniform Residential Landlord and Tenant Act. Many of the proposed changes relate to a landlord’s responsibility and obligations to new tenants. For instance, the bill would prohibit certain uses of rental application fees, require landlords to notify prospective tenants when denying the application and mandate transparency regarding the landlord’s use of resources in evaluating tenant applicants. On January 13, 2025, the Legislature referred this bill to the Judiciary Committee.

LB88 (Dorn) would appropriate $500,000 from the fiscal year 2025-26 and $500,000 from the fiscal year 2026-27 General Fund to the Department of Economic Development for state aid. The bill would instruct the state to use those funds to provide educational programming and technical expertise to aid downtown or main street revitalization, business growth, and historic preservation across the state. On January 14, 2025, the Legislature referred this bill to the Appropriations Committee.

LB90 (Clements) proposes to expand a city of the first class’s power to construct and improve various public spaces. The bill proposes to expand what kinds of spaces cities can improve upon, adding sidewalks, public ways and “other public spaces” to a list that includes streets and alleys. It would also add funding for these improvements, allowing these cities to fund the projects at public cost or by levying special assessments. Further, the bill would expand improvement districts’ ability to make improvements within their jurisdiction and receive funding for such improvements. On January 14, 2025, the Legislature referred this bill to the Urban Affairs Committee.

LB100 (Spivey) would enact the Business Innovation and Startup Act within Nebraska. This act would create the Office of Business, Entrepreneurship, and Innovation, aiming to strengthen policies and programs that support innovation in the state, especially for underserved demographic segments and geographic areas. The bill would encourage various state-level departments to invest more resources and enter into new contracts with Nebraska businesses that are five-years-old or newer. As part of this new act, these entities would also have to file various progress reports with the Legislature showing the amount of resources each entity has invested in the new businesses and how these entities can continue to economically lift up these new businesses. On January 14, 2025, the Legislature referred this bill to the Business and Labor Committee.

LB164 (Spivey) proposes to adopt a new Urban Development Incentive Act. The bill proposes a new grant program to provide funding for eligible projects to developing or rehabilitating affordable commercial spaces in economically distressed areas. The grant funds could be used for eligible project costs such as construction, private financing, down payments, job creation, public consultation, sustainability features, and technical assistance and training related to the project. The bill provides specific percentage and dollar amount cut-offs for each project cost category. The bill also requires annual reports to the Governor and the Legislature. Due to the “emergency” situation this bill aims to address, it would go into effect as soon as passed. On January 15, 2025, the Legislature referred this bill to the Banking, Commerce and Insurance Committee.

LB234 (Conrad) would add to the definition of “economic redevelopment” as it applies to the Urban Redevelopment Act. The bill would include any federal census tract of land directly adjacent to an area as described in the previous definition, expanding the list of areas in Nebraska needing economic redevelopment. On January 16, 2025, the Legislature referred this bill to the Revenue Committee.

LB254 (Hallstrom) proposes to establish Nebraska legislative intent to transfer funds for workforce housing. The bill would transfer $25 million dollars from the General Fund to the Rural Workforce Housing Investment Fund for fiscal year 2025-26 and again in fiscal year 2026-27. Due to the “emergency” situation this bill aims to address, it would go into effect as soon as passed. On January 16, 2025, the Legislature referred this bill to the Appropriations Committee.

ENERGY & RENEWABLE ENERGY

LB20 (Cavanaugh, J.) – please see summary at beginning of article.

LB35 (Brandt) proposes a slight adjustment to provisions relating to renewable energy generation facilities in the Nebraska Sandhills. The bill would modify existing statutes to ensure facilities comply with critical infrastructure protection requirements issued by the North American Electric Reliability Corporation upon reaching commercial operation. On January 13, 2025, the Legislature referred this bill to the Natural Resources Committee.

LB43 (DeKay) would change provisions and definitions relating to notice and certification requirements for electric generation facilities, transmission lines, and privately developed renewable energy generation facilities located near military installations. The bill would require those constructing, expanding, altering, or repairing such electric generation facilities within a ten-mile radius of military facilities to provide notice of the work and certify they are using no electronic equipment manufactured by a foreign government or adversary. The Nebraska Power Review Board may certify a noncompliant use of materials if there is no other reasonable procurement option available or greater harm would be caused by not using the equipment or components. On January 13, 2025, the Legislature referred this bill to the Natural Resources Committee.

LB91 (DeKay) proposes to make small adjustments to section 70-650.01. With the changes, any public power district or public power and irrigation district that acquires any electric distribution system located within any city or village of Nebraska must transfer all its interest in the system, with cost, to the city or village. Further, the bill would ensure that in addition to any public power district, any city or village that does not have an agreement with any public power and irrigation district can determine what it wants to include in the term “distribution system” through a declaratory judgment. On January 14, 2025, the Legislature referred this bill to the Natural Resources Committee.

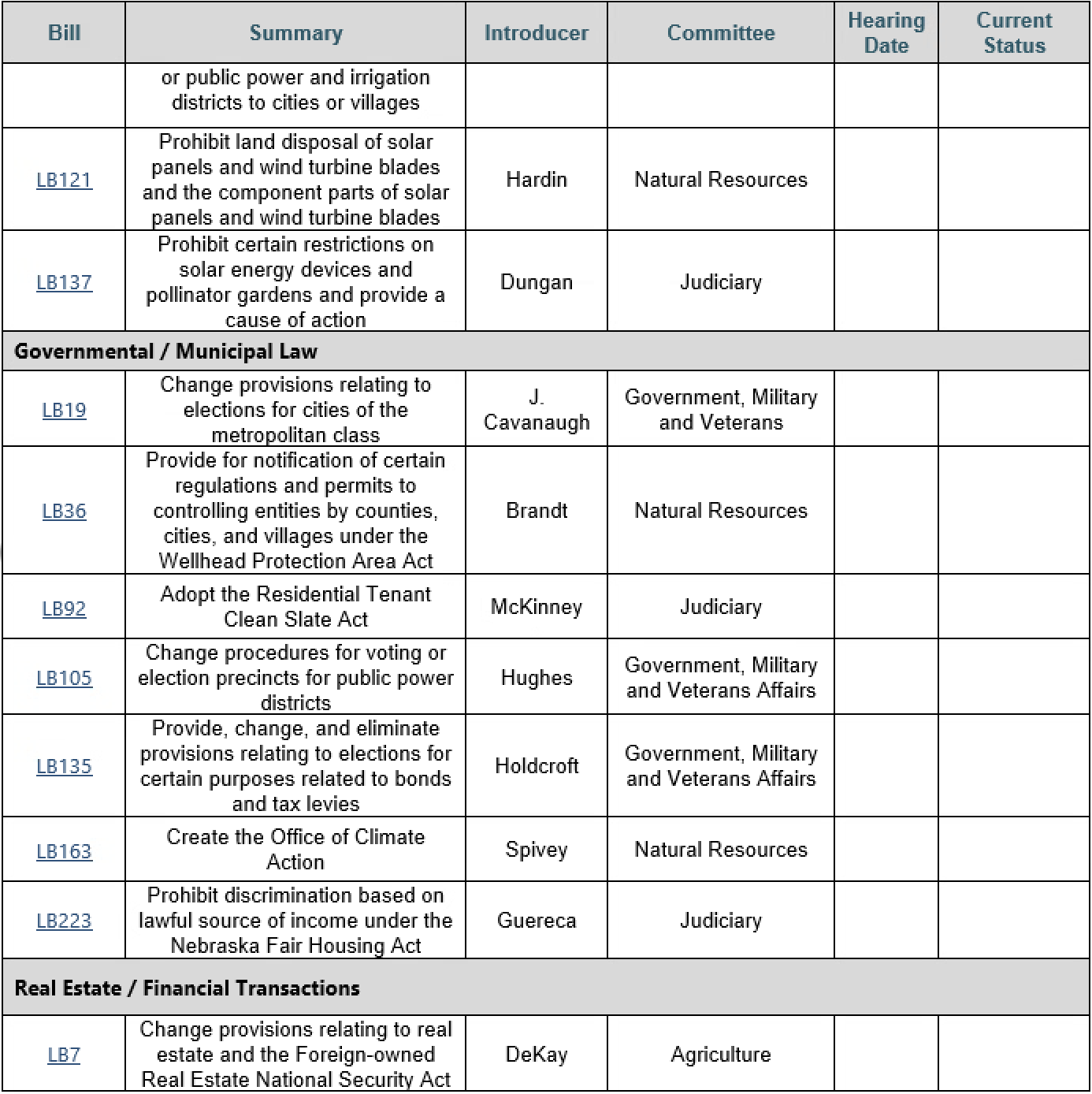

LB121 (Hardin) – please see summary at beginning of article.

LB137 (Dungan) would prohibit homeowner associations and similar entities from restricting the installation of or use of solar energy collectors or pollinator gardens. It would also prohibit these associations from assessing any charge or fee for the placement of these solar energy collectors and pollinator gardens. Finally, it would render any currently existing covenant, agreement, term or contract with similar terms prohibiting these constructions void and unenforceable. On January 15, 2025, the Legislature referred this bill to the Judiciary Committee.

GOVERNMENTAL & MUNICIPAL LAW

LB19 (Cavanaugh, J.) proposes to change the election process for officers serving cities of the metropolitan class, including the actual term for the elected officers. On January 13, 2025, the Legislature referred this bill to the Government, Military and Veterans Affairs Committee.

LB92 (McKinney) proposes to implement the Residential Tenant Clean Slate Act. For individuals that were previously evicted and meet certain criteria (i.e., a court never issued a writ of restitution, the tenant was evicted during the COVID-19 pandemic, among others), the act would allow a court to wipe the tenant’s previous evicted status from the public record. The act would seal that information, shield the tenant from questioning regarding the sealed information, and overall give a previously evicted tenant a new chance to rent housing without their previous eviction status coloring the application process. On January 14, 2025, the Legislature referred this bill to the Judiciary Committee.

LB105 (Hughes) would modify the election procedures for public power districts by allowing operating area boundary lines to be coincident with whole or divided voting precincts. The bill would not require the approval of the Secretary of State for such changes and would allow greater flexibility in establishing subdivisions and boards of directors when the operating area contains multiple counties. On January 14, 2025, the Legislature referred this bill to the Government, Military and Veterans Affairs Committee.

LB135 (Holdcroft) proposes to revise and bolster the school board election process by giving the election commissioner greater power over the process. On January 15, 2025, the Legislature referred this bill to the Government, Military and Veterans Affairs Committee.

LB163 (Spivey) would create the “Office of Climate Action” within the Department of Environment and Energy. The Office of Climate Action would work with various entities across the state to provide support, enhance education, and expand access to resources that support climate change. The bill would ensure the Office of Climate Action created annual internal plans and filed annual reports with the Clerk of the Legislature detailing the progress the office made toward its goals each year. On January 15, 2025, the Legislature referred this bill to the Natural Resources Committee.

LB223 (Guereca) proposes to ensure no individual seeking housing is discriminated against based upon their lawful source of income. This bill would prohibit entities from discriminating against potential tenants or lessees based on receipt of social security, child support, alimony, foster care subsidies, veteran benefits, housing credit or other similar income. On January 16, 2025, the Legislature referred this bill to the Judiciary Committee.

REAL ESTATE & FINANCIAL TRANSACTIONS

LB7 (DeKay) – please see summary at beginning of article.

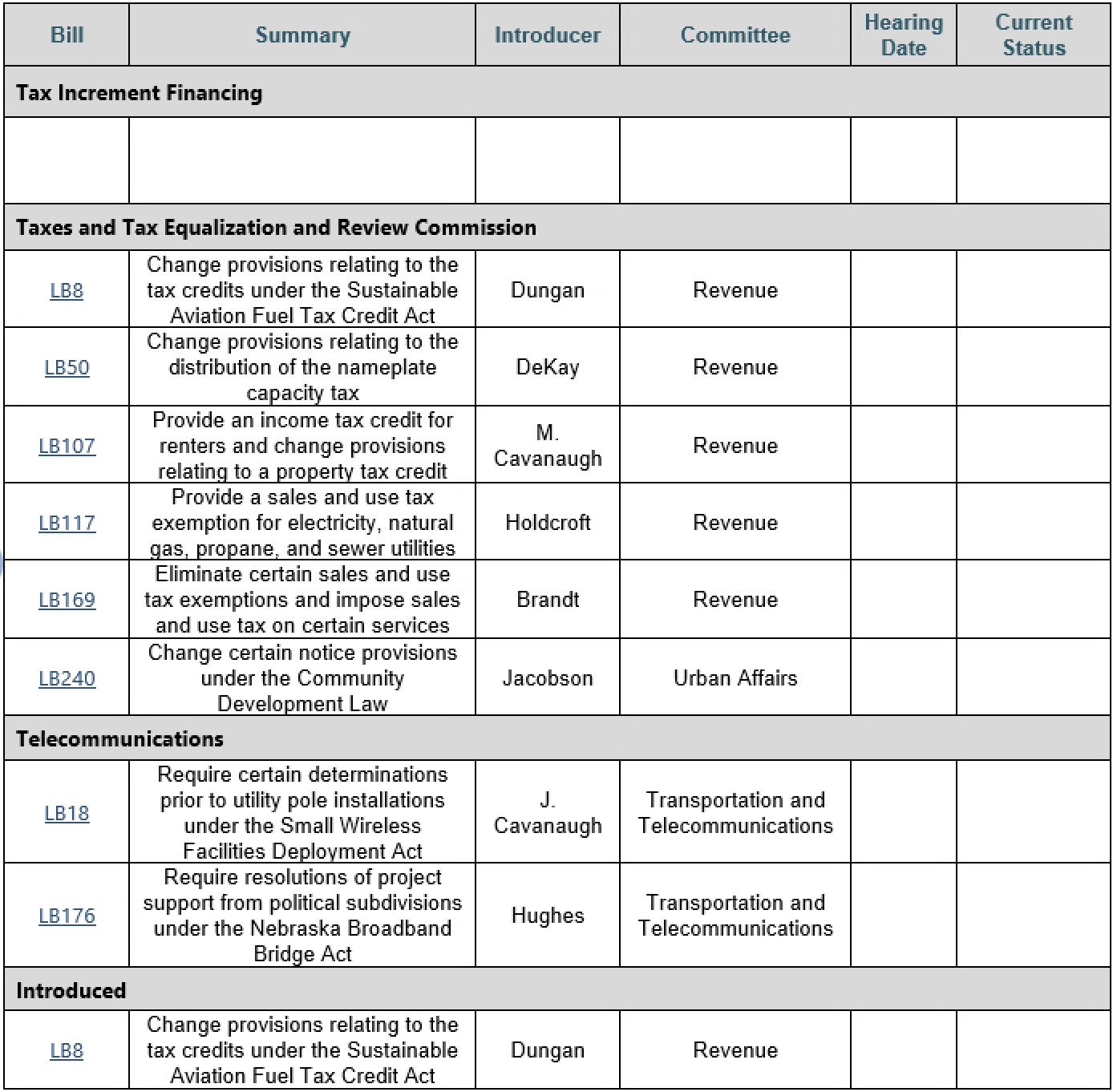

TAX INCREMENT FINANCING (TIF)

No legislative bills introduced in this category.

TAXATION & TAX EQUALIZATION AND REVIEW COMMISSION (TERC)

LB8 (Dungan) would change the Sustainable Aviation Fuel Tax Credit from a nonrefundable income tax credit to a refundable credit. It would also change when the law makes the credit available from January 1, 2027 to January 1, 2028. On January 13, 2025, the Legislature referred this bill to the Revenue Committee.

LB50 (DeKay) – please see summary at beginning of article.

LB107 (Cavanaugh, M.) proposes to change existing provisions relating to property tax credits and provide a new income tax credit for renters. The bill would allow a state personal income tax credit for any individual renting a house, apartment, or other residential unit in the state of Nebraska. The tax credit would be equal to four percent (4%) of the total amount of rent paid in the taxable year or two hundred dollars ($200), whichever is greater, up to one thousand dollars ($1,000). The bill also modifies the amount of property tax credit permitted under Nebraska law to allow up to two hundred million dollars ($200,000,000) of relief in the state each year. On January 14, 2025, the Legislature referred this bill to the Revenue Committee.

LB117 (Holdcroft) would provide a sales and use tax exemption for electricity, natural gas, propane, and sewer utilities. The bill would apply at apartment residences where the cost of utilities is paid as a separate line-item charge from rent, and at commercial properties where the primary use of the property is as one or more primary residences. On January 14, 2025, the Legislature referred this bill to the Revenue Committee.

LB169 (Brandt) proposes to make several minor modifications to revenue and taxation requirements relating to agriculture and livestock. For example, the bill would require agricultural tax expenditure reports to address specialty and veterinary services performed on livestock and would similarly update taxation definitions of “gross receipts for providing a service” to include livestock and other personal services. On January 15, 2025, the Legislature referred this bill to the Revenue Committee.

LB240 (Jacobson) proposes small adjustments to notice provisions under the Community Development Law. The bill would require the taxing authority to send notice of provisions for dividing ad valorem taxes before July 1 each taxable year, rather than August 1 as was done previously. On January 16, 2025, the Legislature referred this bill to the Urban Affairs Committee.

TELECOMMUNICATIONS

LB18 (Cavanaugh, J.) would grant Nebraska authorities the ability to further regulate the installation or modification of utility poles in rights-of-way. The bill would allow authorities to determine whether a utility pole: (1) complies with the federal American with Disabilities Act and the federal regulations the government adopted in response to the act; (2) obstructs or hinders public safety or travel in or on a right-of-way; and (3) obstructs the legal use of a right-of-way by any utility or impedes the safe operation of such utility’s provision of its service. If an authority determines the utility pole interferes with any of the above, the bill would allow the authority to deny the installation of the utility pole. On January 13, 2025, the Legislature referred this bill to the Transportation and Telecommunications Committee.

LB176 (Hughes) proposes to amend the Nebraska Broadband Bridge Act to require resolutions of project support from political subdivisions. The bill alters the existing program to require grant applications to include a resolution of project support from each county, city, and village in which the developer plans to locate the proposed broadband project. The resolution must include a map of the proposed project area, acknowledgement of appropriate permits, and a proposed timeline for project completion. On January 15, 2025, the Legislature referred this bill to the Transportation and Telecommunications Committee.